Recently, the Federal Reserve, simply known to many as the Fed, once again raised interest rates with the purpose of bringing down the inflation rate. This action has a direct impact on anyone borrowing money, and this includes most dairy farms. If you read the news following the Fed’s action, most media mentioned that borrowing money will be more costly. Although the latter is quite obvious, what does that mean to a dairy farm?

Consider time value of money

The time value of money is a key principle needed to be understood when borrowing money. Most readers are likely familiar with this concept, but a refresher is always welcome. Based on this principle, money today is worth more than the same amount in the future.

What does this mean? Let’s say that if I borrow $100 today from a lender at a 6% interest rate, after one year I will have to pay back $106. This means the future value of that $100 (its present value) is $106. So far, everything is quite straightforward.

The challenge is to visualize the present value of the money generated in the future. Let’s say that I expect my investment to generate $100 next year (future value), and I need to use that money to pay my investment. At a 6% interest rate, the $100 generated in the future would pay about $94 of the money I borrow in the present ($100 / 1.06 = $94.33). Therefore, the money generated in the future ($100) is worth less ($94) than the same amount of money borrowed in the present ($100).

There are at least two ways of looking at the implications of this principle. First, if I borrow $100 today and want to pay the loan in no more than one year, then the investment must generate at least $106 in the future. Alternatively, if I borrow $100 today and generate just $100 in the future, then it will take me more time than one year to pay the loan.

A dairy scenario

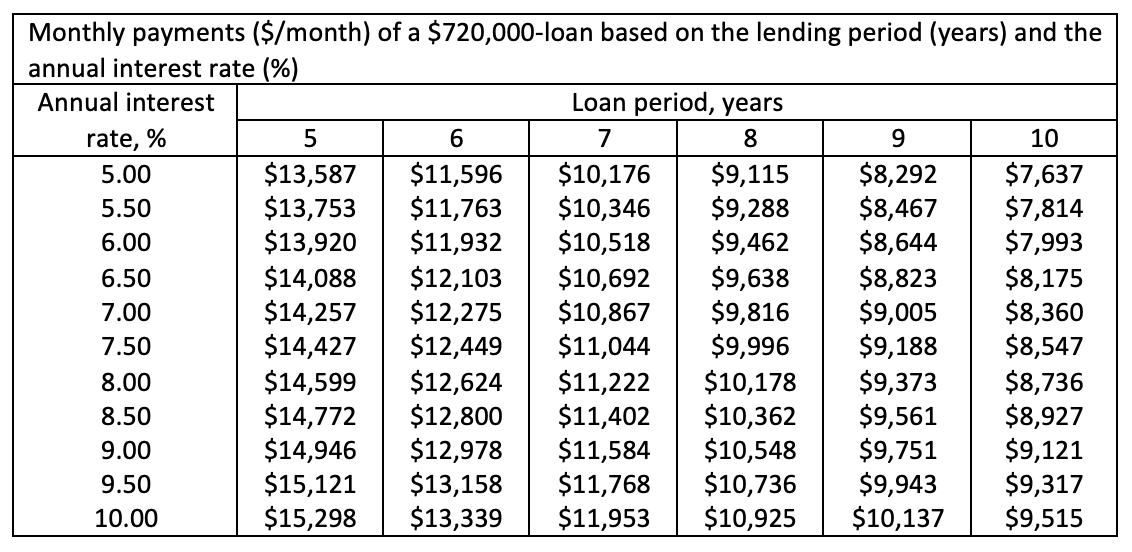

With this in mind, imagine a scenario in which $720,000 is borrowed for an expansion of a dairy farm or an upgrade of a milking system. To add perspective, if this investment is for a 120-cow project, then the investment per cow would be $6,000 per cow. If the annual interest rate of the loan equals 6%, then the monthly payment would be $7,333 per month (see table). If the annual interest rate of the loan rises to 6.75%, then the monthly payment would instead be $8,267 per month. This means that the 0.75%-increase of the annual interest rate to this expansion or upgrade project will cost approximately $11,200 more per year [($8,267-$7,333) x 12 months] for the following 10 years. From another perspective, if the net cash flow generated by the project stays constant, the loan would be paid in 10 years and six months rather than in just 10 years.

Evaluating capital investments can be tedious, and that is not the purpose of this article. However, putting some perspective on the Fed’s action might help to visualize its impact. Only as a reference, the table below describes how the estimated monthly payments for a $720,000-loan would vary as affected by the length of the loan and the annual interest rate.