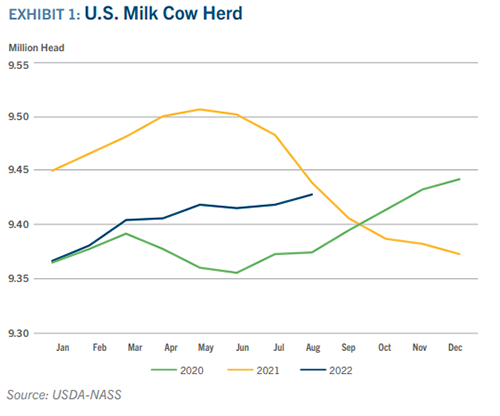

The U.S. dairy cow herd continued its gradual rebuilding last quarter with dairy farmers slowly adding more cows to the herd as milk prices hit historic highs. Producers, though, remain hobbled by high feed and labor costs and tight heifer availability, which is limiting herd growth despite positive margins.

As of August, milk cow numbers in the U.S. totaled 9.427 million head, up 60,000 head year-to-date but still trailing year-ago levels by 11,000 head. Notably, the Texas dairy herd jumped by 30,000 head while South Dakota added 22,000 head, indicating that the U.S. dairy herd continues to migrate from high-cost coastal regions to central states that benefit from lower costs associated with land, water, feed, and labor. As for the topside on cow numbers? The national herd needs to add about 80,000 cows to eclipse the modern-day record of 9.507 million head, which was set in May of 2021.

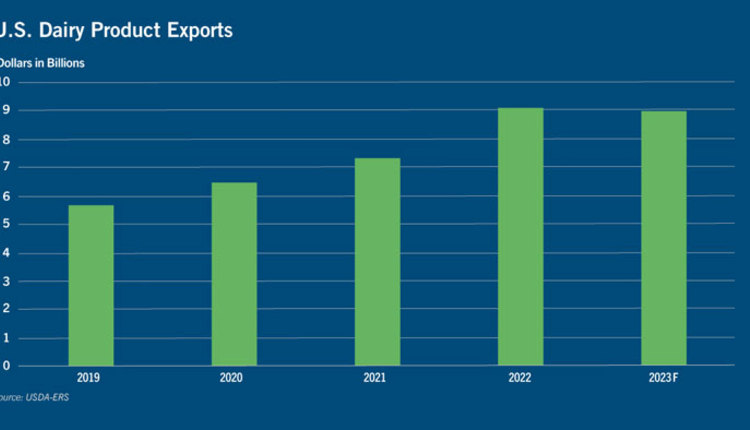

Base programs with milk cooperatives also continue to restrain production growth in the U.S. at a time of tight global supplies and record domestic consumption and exports of U.S. dairy products. Strong — if not record — profitability on the farm earlier this year has not translated into robust nationwide investment in herd expansion that would have normally followed record-high milk prices. Base programs in some cases have been the primary reason for lethargic or stagnant herd growth.

Producers continue to make advances in productivity, though, making up for slow herd growth and allowing total milk production to rise above year-ago levels. Milk collections in August tallied 19.02 billion pounds., up 1.6% year-over-year.

Future growth in the U.S. herd for the remainder of 2022 and into 2023 will likely continue its incremental pace as rising productivity takes a greater role in meeting consumer demand for dairy products. Based on the current futures curves for both corn and Class III milk on the CME, a moderation in milk prices will be accompanied by rising feed costs over the next six months. That’s a red flag on future milk production margins nationwide, and it will surely cause many to rethink plans for expansion.

However, regions like Texas that benefit from lower feed costs will likely continue adding cows. New cheese processing capacity slated to come on line next spring will only add more tailwind to the growth of the Texas herd. The inertia for cows and plants to move to the central U.S. is building.