U.S. dairy exports carried major momentum into the final quarter of 2022, with nearly all the major dairy products showing year-over-year improvement. Indeed, cheese, whey, butter, and other dairy products all posted strong gains in November when compared to last year, with only nonfat dry milk shipments seeing a material slowdown.

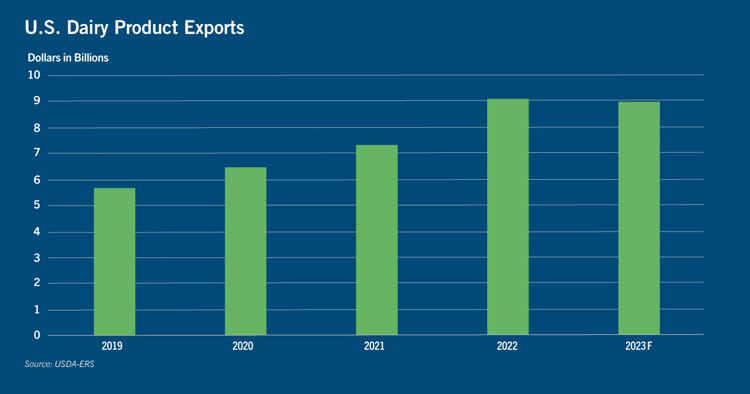

With only December data still needed to round out the year, 2022 is already on the books as a record year for dairy exports. These record sales were bolstered by the recent weakening of the U.S. dollar in the final quarter of 2022.

That was last year.

The outlook for U.S. dairy exports in the first half of 2023 is deteriorating as inflation erodes consumers’ purchasing power around the world and more competitive prices in Europe and Oceania dampen demand for U.S. product. Rising global economic uncertainties – particularly in China, which has struggled with reopening its economy after several months of COVID-19 lockdowns – have clouded the outlook for demand for dairy products. With China being the world’s largest dairy importer, their economic woes ripple through the dairy world.

China’s Lunar New Year celebrations in January traditionally drive an increase in Chinese dairy demand, but surging COVID-19 cases will restrain demand growth as some consumers self-quarantine.

Chinese milk production, meanwhile, has continually improved. The continual drop in prices on the Global Dairy Trade (GDT) reflects the growing economic uncertainty and increase in Chinese milk and dairy product supply, which helps drag down U.S. milk and dairy product prices.

Across the Atlantic, European farmers have benefited from unseasonably warm weather and a drop in feed prices while farmers’ milk checks still remain strong and have yet to reflect the drop in spot milk prices – thereby continuing to signal to farmers to increase production. With milk and dairy products growing in supply, and with Europe benefiting from a weaker currency relative to the U.S. dollar, the U.S. faces dual headwinds of competitively priced European dairy products in a global market where consumers are ultra-price sensitive.

In their Outlook for Agricultural Trade released in November, USDA projected dairy exports to tally $8.9 billion in 2023. If realized, that would be down 1.9% year-over-year.

Although USDA sees exports declining, their export projection – if realized – is still well above prior years and the second-highest on record. The first half of 2023 is setting up to be a rough start on dairy exports, but many of the current economic headwinds to U.S. dairy exports will subside. As China’s economy recovers, and as European milk production slows, the U.S. will be positioned to capture export business later in the year.