Dairy product manufacturers are running operations full tilt in the midst of the spring milk flush despite ongoing struggles with supply chain constraints, specifically trucking and labor. The abundant flow of milk has resulted in record production of some dairy products.

Cheese manufacturers produced a record amount of cheese at the start of the year, with January and February both notching new high marks. Meanwhile, the pace of butter, nonfat dry milk, and skim milk production also showed improvements over the prior year. The seasonal spike in supply, though, unfortunately collides with a slowing export pace.

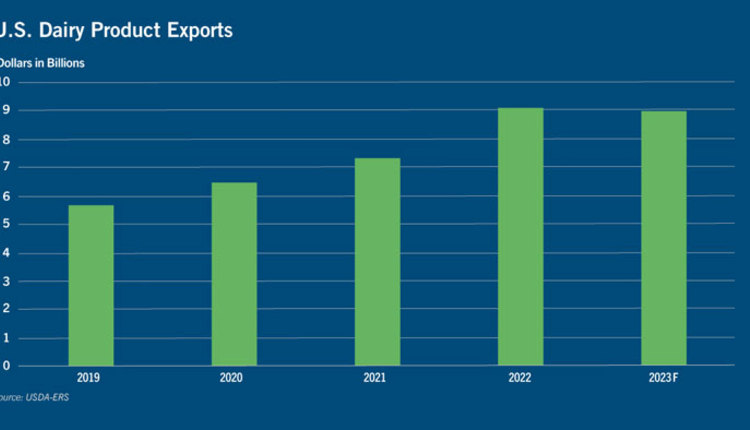

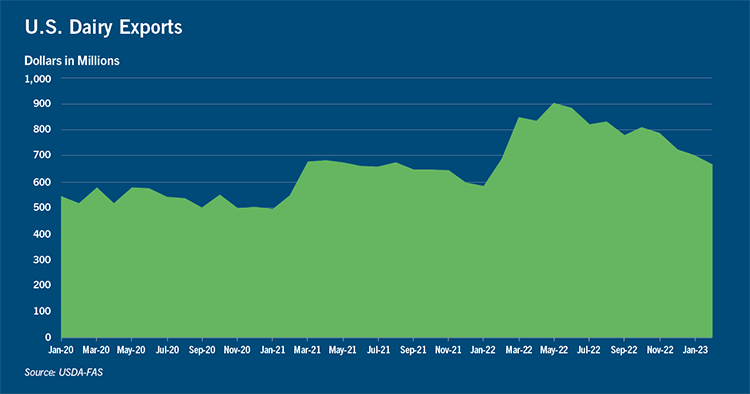

As expected, dairy exports are showing signs of lethargy, commensurate with a weakening global economy that is struggling under the trifecta of inflation, rising interest rates, and geopolitical uncertainty. For the first time in over a year, the export pace in February shrank from the year prior. U.S. dairy exports for the month slipped to 458.5 million pounds, down 0.3% year-over-year. On a value basis, exports slowed 3.3% year-over-year to $665.6 million.

The important Southeast Asian market is waving some red flags as shipments to Vietnam, the Philippines, and Indonesia are showing notable declines compared to last year’s pace. It’s worth noting that Mexico — a key driver of U.S. dairy export growth — has held firmly to its role as a growth market, taking record amounts of cheese and nonfat dry milk. China is also quickening its imports of dry whey in tandem with their recent buying spree of U.S. corn — a signal that perhaps the feed situation in China is tighter than previously thought as their hog sector recovers from African Swine Fever.

Stocks of butter, nonfat dry milk, and whey continue to climb as production accelerates, while cheese stocks remain in check amid persistent exports. A slowing global economy is raising concerns of weakening international demand ahead for dairy products while high retail prices in the U.S. are dampening demand growth.

As farmer margins come under greater pressure with milk prices having dipped below $18 per hundredweight (cwt.) while feed prices remain resilient, a downturn in milk production is in offing in the months ahead. A tighter milk supply will invariably result in manufacturers adjusting their processing pace — a dynamic that will be interesting as it plays out between cheese and butter producers.