Last month, I wrote about the zero-covid policies being lifted in China and concluded that we should see a rebound in demand once they moved through the current wave of infections. It is still too early to say what their post-pandemic demand looks like, but the early indications appear to be good.

So, we are optimistic about Chinese dairy demand in 2023, but we are also concerned that its growing milk production may limit import growth during 2023. I know this seems only remotely connected to the day-to-day life on a U.S. dairy farm, but every 1% change in Chinese imports drives a roughly 1% change in U.S. dairy prices. How does that impact 2023? Depending on how strong domestic production and/or consumption growth is in China this year, imports could range from down 7% to up 15%. Admittedly, that is a big spread.

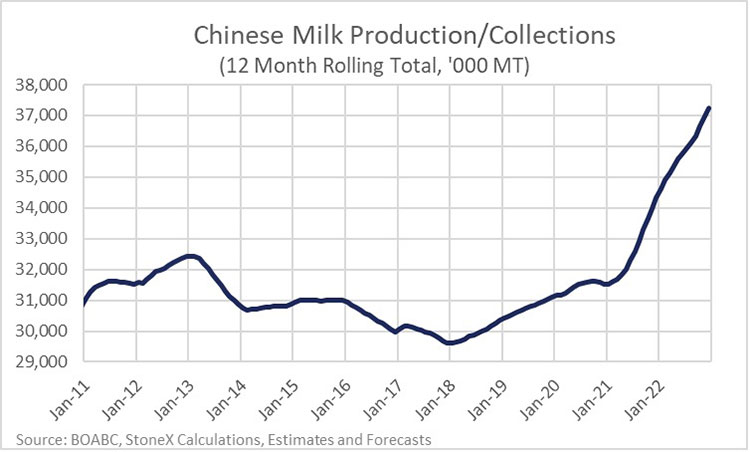

China’s domestic milk production data

First, let me say I have reservations about the Chinese milk production data. The data doesn’t capture all of the milk in the country, and it can show some wild swings and anomalies. At the same time, the data seems to be gaining more acceptance in the industry. The monthly data only goes back to 2017, but I have tried to create an estimated series that is consistent with the recent data that goes back to 2008. The most notable feature is the surge in production during 2021 and 2022, which looks massive and unprecedented. To be fair, it is at least unprecedented in the past 15 years.

There is always a lag between milk prices and changes in production, whether you are talking about the U.S., Europe, or China. Some of the recent production growth in China is driven by record-high milk prices and margins in 2021, but margins have been collapsing for the past 12 months, so we can’t attribute all of this growth to economic drivers.

We’ve heard a lot of anecdotal comments from customers in China that the government has been encouraging more production and consumption of domestically produced milk. That has always been its policy. Nearly every country in the world wants to produce most of its own food; no one feels great being dependent on imports from another to eat. But the cost of producing milk in China is high and imports are relatively cheap, which has limited production growth in the past.

Why would the government suddenly be putting more pressure on the Chinese dairy industry to produce more milk? One possible explanation is because the governments of the two largest exporters of dairy products (the EU and New Zealand) are increasingly tightening environmental restrictions, which are, or is expected to, limit milk production and exports. The EU and New Zealand are telling the world that their priorities have changed and the period of abundant and constantly growing milk supplies is over.

It looks like China has listened.

Don’t get me wrong, China is not suddenly self-sufficient in milk production. Depending on how you calculate it, they are still importing 25% to 35% of their consumption. I still see imports growing over the next five years. However, if they can continue to grow milk production at about 6% per year — and they were over 8% in 2021 and 2022 — then imports could be roughly flat.

The Chinese economy is starting to open up with the removal of COVID-19 restrictions. It will be bumpy and not everyone is ready to start sitting down at restaurants with other people yet. But Chinese consumers are sitting on a pile of savings the way consumers in the West were, and there is a clear eagerness among many to get back out into the world and experience the things they’ve missed out on for the past three years. We expect dairy demand in the country to bounce higher in 2023, but strong growth in milk production could limit its dairy import growth despite the good demand.