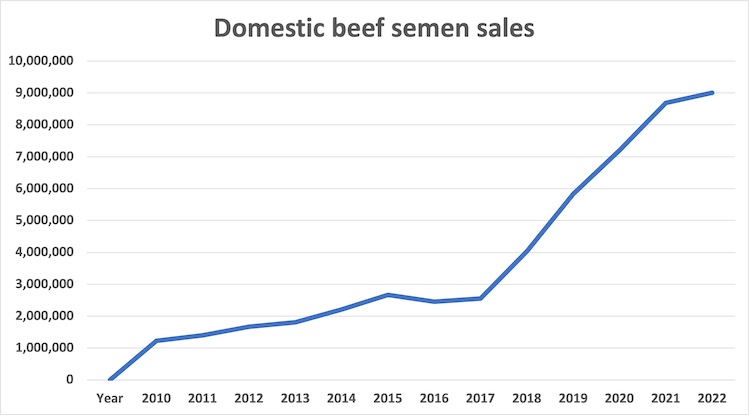

A record 9 million units of beef semen were sold to U.S. dairy farmers and cattle ranchers last year. This is an impressive number considering that sales stood at what was at that time a record 2.5 million units in 2015.

While actual units of beef semen sold within the U.S. have shot toward the moon with 6.5 million units of growth from 2015 to 2022, the percentage gains moderate each year as momentum continues in the category. While the annual growth rate ranged from 1.3 to 1.7 million units in the category from 2018 to 2021, percentage growth slipped from 58% in 2018 to 21% by 2021. That’s because the denominator (larger sales total) in the math equation continues to grow each year.

Even though 2022 posted a fifth straight sales record, sales were up only 3.7%. That took place as beef units grew by 322,000 units, moving from 8.7 to 9 million units over the past two years, according to sales data posted by the National Association of Animal Breeders (NAAB).

Part of a triple play

Beef on dairy is a part of a triple play that began over a decade ago.

That triple play involves sexed semen, genomic tests, and beef on dairy.

First came sexed semen that delivered more heifer calves. On a growing number of U.S. dairy farms, a large portion of virgin heifers are bred to sexed semen to not only get future replacements from the best genetics on the farm, but those resulting newborn heifer calves allow their first-time dams to have an easier birthing process and subsequently transition into the milking herd with fewer health issues. As a result, sexed dairy semen now represents 49% of the dairy units used by U.S. dairy producers, reported NAAB.

Flush with heifer calves, the second part of the triple play — genomic testing — gained significant momentum. First introduced to the industry in 2008, it took a full seven years in order for one million tests to be run in the collective U.S. dairy herd.

Then testing took off as six million tests were run in the next eight years. The U.S. passed the seven-million threshold in December 2022 as well over one million genomic tests were performed on females in the U.S. last year. These one-million-plus genomic tests are taking place in a national dairy herd with just over nine million cows.

With plenty of replacements and equipped with the ability to sort out the very best heifers with over 70% accuracy by running a genomic test at birth, farmers are now preselecting the heifers and cows that will generate their replacements. Many of the other members of the dairy herd get bred to beef to capture additional value in the beef market. This strategy allows farmers to reduce one of the largest expense categories on the dairy — feed and feeding replacements.

A megatrend that’s reshaping the dairy herd

Until recent years, NAAB could not differentiate where beef semen sales were going . . . into dairy or beef animals. With enhanced data collection, NAAB reported that the units of beef semen used on dairies rose by 457,000 units while beef used in beef herds dropped. While not assigning a number to the reduction on sales to beef operations, data would indicate sales on cattle ranches dropped by roughly 135,000 units this past year. As part of the triple play, sex-sorted dairy semen rose by 245,000 units or 3% in 2022.

From an economic standpoint, beef may be dairy’s best bet in 2023. That’s because strong demand coupled with limited supply as the nation’s beef cow herd stands at the lowest level since 1962 will result in strong beef prices.

Long-term, beef on dairy will continue to transform the nation’s feedlots. CattleFax reported that there were an estimated 2.6 million beef-on-dairy calves born in 2022. That’s up from 2018’s 410,000 head and represents 2.2 million more beef-on-dairy animals in a short span. CattleFax reports that there is a 4 to 5 million head potential by as soon as 2026.

At the moment, beef-on-dairy accounts for 7% of the fed slaughter category. If the trends continue, 15% of the fed-slaughter category could be beef-on-dairy feeders by 2026, projected CattleFax.