EVEN WITH THE U.S. ALL-MILK PRICE above $22 per cwt. for the first two months of the year, profitability is suffering for most producers. “It turns out that feed costs are largely to blame,” said Scott Brown.

“COMPARING THE FIRST TWO MONTHS OF 2023 with averages from 2010 to 2019 reveals that milk prices are $3.88 per cwt. higher,” said the University of Missouri economist. “However, corn prices are also up $2.27 per bushel, soybean meal prices are nearly $125 per ton higher, and alfalfa prices in the DMC margin calculation have jumped $125 per ton.”

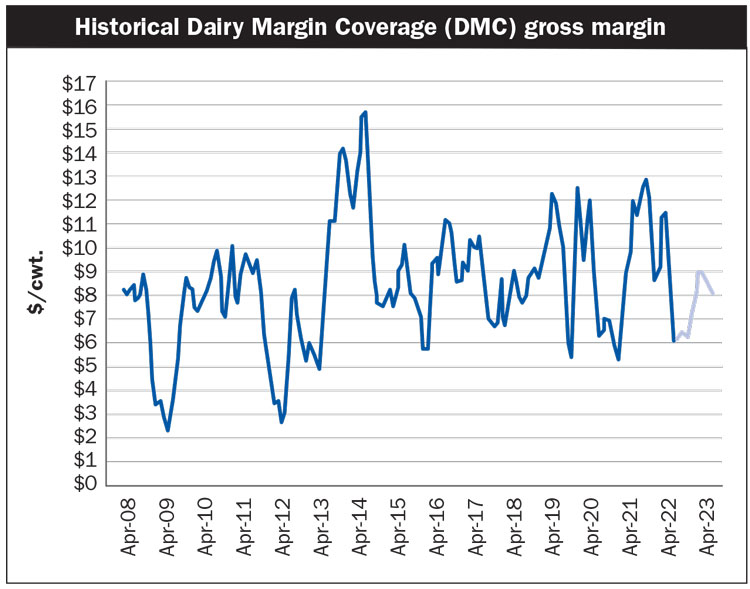

“THAT HAS LEFT the January and February 2023 DMC margin $1.56 per cwt. lower than the average from 2010 to 2019,” explained Brown.

DAIRY MARGIN COVERAGE PAYMENTS took place in both January and February, largely driven by high feed costs. In January, the milk margin above feed costs was $7.94. That number slid to $6.19 in February. Given the mix of high feed costs and lower milk prices when compared to last year, DMC payments could continue for the foreseeable future.

HELP MAY BE ON THE WAY as USDA forecasted that farmers intend to plant 92 million acres of corn in 2023. Planted acreage for corn could be up or unchanged in 40 of the 48 estimating states. If realized, corn acreage would be up 4% or 3.6 million acres from the past year. Soybean growers intend to plant 87.5 million acres, with record acreage projected in Illinois, Nebraska, New York, Ohio, and Wisconsin.

APRIL-TO-SEPTEMBER CLASS III CONTRACTS held rather steady from March 1 to April 6 trading at $18.70. The equivalent Class IV contracts slid from $19.40 to $18.10 in the same 37-day window. October-to-December Class III contracts netted $19.45 and Class IV averaged $19.10.

AFTER A LOFTY JANUARY, U.S. dairy exports eked out a 0.8% gain on a volume basis. However, February’s export value declined for the first time in over two years due to lower dairy product prices and a higher proportion of the portfolio supported by lactose, which has a lower unit value.

TWO PROCESSING GROUPS CALLED FOR a Federal Milk Marketing Order hearing to update make allowances. Two producer groups pushed back on the issue, calling for a comprehensive review on the matter.

WHILE INDUSTRY MARGINS (as shown in the graph below) have been challenging, opportunities exist on the horizon. Read more on page 242.