Milk prices are finally on the rise, and some of that is thanks to what’s going on in beef markets.

The USDA Cattle report that is released in January and July each year provides a snapshot of one dairy herd data point in particular that otherwise has limited visibility: the estimated number of heifers intended for milk cow replacement. But the most recent report also includes other numbers that hint at what could drive reductions in the milk cow herd in the second half of this year.

Heifers that are at least 500 pounds and intended for milk cow replacement were reported at 3.65 million head as of July 1, 2023. That’s down 100,000 head from the same time last year and is a continuation of the declines seen since 2018. Replacement costs are typically among the top three expense areas on a dairy along with feed and labor, so when milk revenues are low, it can be an area of focus for managing costs.

Beyond just the dairy heifer number, the report highlights constrictions in the total cattle herd.

The total cattle and calves count, at 95.9 million head, was down 3% from last year and is only barely above a multidecade low. The only number that didn’t fall from last year was milk cows, which came in at 9.4 million head, flat with last year. But that might not be the case for long.

Shrinking dairy herd is a beef story

Low cattle numbers on the beef side have driven prices up dramatically, which pulls on the dairy herd from both ends.

There is a greater incentive to implement dairy-beef cross genetics, which can contribute to shrinking the dairy replacement heifer herd. Breeding to beef can add a higher revenue stream, but it also diverts animals from what otherwise would have been the replacement pool.

Over the past five years, the July heifer inventory for milk cow replacement has fallen 13%. As a share of the total milk cow herd, heifer inventory has gone from 44.7% to 38.8%. Low beef cattle inventories have created a more enticing opportunity for dairies that have been working on dairy-beef cross programs in recent years.

Meanwhile, on the other end of the dairy herd, the high beef prices are driving cull values higher.

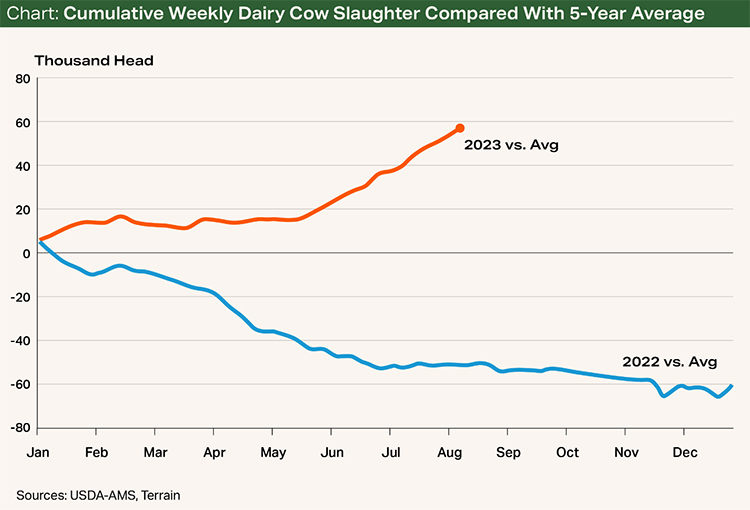

As a result, dairy cow slaughter rates are up dramatically to levels previously seen only during the government herd buyout program in the mid-1980s. Cumulative dairy cow slaughter year to date is 108,700 head higher than at this point last year and 57,000 head above the five-year average at this point in the year.

Lower supply should offer some price support

Producers still face a trade-off between high cull values and high replacement costs. Where that trade-off falls for any individual operation is going to vary, which contributes to some uncertainty about the ultimate impact on the U.S. milk cow herd. But I wouldn’t be surprised to see continued declines in the herd in the coming USDA Milk Production reports.

A contracting milk cow herd should provide a degree of support under milk prices. Tighter supply should limit downside price movements from current levels, but any meaningful improvements will depend on strengthening demand. A strong holiday season could help domestic demand, but sluggish exports are still likely to be a headwind against dramatic price movements higher for the rest of 2023.