The Spaghetti Western film - The Good, the Bad and the Ugly - had a complex plot where three cowboys form an uneasy alliance to find hidden gold. Of course, good triumphs over bad . . . and good eventually outsmarts ugly. As I look ahead at the dairy industry in 2015, I see some of the good, probably some bad and, who knows, maybe even some ugly.

The Good

The dairy industry experienced the highest milk prices and best margins of all time in 2014. Farms have had a great year to restore balance sheets, replace capital, pre-purchase inputs and otherwise celebrate a very good year.

We've also seen the highest cheese, butter and nonfat dry milk prices of all time - and consumers weren't scared off. In fact, consumers' confidence in the economy has been steadily growing since the recession of 2009, and folks are making their way back into restaurants where dairy products are prominently featured on the menu. The profitable year for dairy is a result of markets trying to tell producers that they want more milk and dairy products.

The Bad

Dairy producers are listening to consumers. We have heard them telling us that they want more dairy products and we are willing to provide them. The rate of dairy cow slaughter was well below recent years. The result of holding back on those cows was a growth in the national herd that paralleled the gains in 2008. More cows, coupled with inexpensive feed and more milk per cow, has yielded us more milk production.

The pace picked up quite a bit by the time we got half way through 2014 and it hasn't slowed down yet. Sooner or later, the market will have all the milk it wants and, predictably, prices will tumble. In fact, they have already started to fall.

Futures markets have built a substantial price decline into the coming year. The All-Milk price is forecast to descend to a low of about $18 per hundredweight (cwt.) by April or May and then improve somewhat. The milk price is expected to average about $5.50 lower than 2014.

To take some of the sting out of that milk price forecast, feed prices will also be substantially lower in the year ahead. Given all of that bad news, I'm not sure we are done yet.

The Ugly

As the world's third largest exporter of dairy products, the U.S. is a member of a fairly select group. But club membership has dues that aren't always fun to pay.

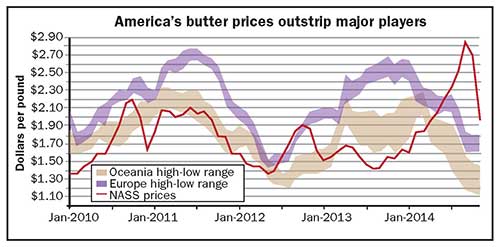

Tight butter stocks drove the U.S. butter prices to extraordinary levels in the second half of 2014. In fact, our butter prices were rising rather dramatically when the other two major exporters - the European Union and New Zealand - were dropping about as fast as we were going in the other direction. To a lesser extent, cheese prices were following a similar pattern.

We can't be competitive when our prices diverge significantly from other exporters. Minor deviations in price can be ignored for a short time, but if they are too big, then arbitrage will drive them back together. Either we won't sell as much overseas and the extra product on our domestic markets will lower our price (that is part of what happened with the price decline in 2009). Or, if the price difference is big enough, as it was with butter in the fall, we become an attractive destination for other countries to sell butter to us.

New Zealand has been having good rains at the start of their production season. And, buoyed by the enthusiasm of ending milk quotas this coming spring, several countries of the European Union are gearing up for higher production.

The elevated milk production hasn't found the bottom of product prices in world markets yet. Our prices have begun their descent but we still can't be sure where they will stop. If I put U.S. product prices into a currently competitive relationship with the E.U. and New Zealand, then our Class III and Class IV milk prices should be about $15 and $12, respectively, which is well below what futures markets are forecasting.

In recent years, we have found China's demand for dairy products to be almost endless. Their growth in disposable income has supported stepped up per capita consumption. Although the gain in their Gross Domestic Product (GDP) on a percentage basis is still quite a bit higher than ours, it is significantly slower than it has been in the past decade. I have no doubt that we will continue to see additional sales to China, but the rate of growth could slow as a result.

Let's put it in perspective

This year will go into the books as a rare one on par with the best of late 2007 and early 2008. It's fun to have a year like 2014 but we simply can't sustain the kind of growth in milk production that it stimulates. We remember all too well that 2009 followed our last great price year.

There is nothing that suggests another 2009 on the horizon. That was an extreme event in part due to the global recession. The current projections for the MPP margin is for a return to a fairly normal level. If that just taps the brakes on milk production, then the dairy industry should have a reasonable year of milk prices relative to feed costs. That is what I'm expecting.

Let's keep our eye on the market and make our risk management plans in the year ahead with the new MPP and futures and options.