The author is the Director, Market Intelligence, American Farm Bureau Federation.

To comment, email your remarks to intel@hoards.com. (c) Hoard's Dairyman Intel 2017 December 4, 2017

USDA just released long-term Agricultural Projections to 2027 for the U.S. dairy industry. With these forecasts, USDA confirmed what we’ve all known for some time: the key to success for U.S. dairy producers and dairy farm income lies outside U.S. borders.

Counting on higher milk prices?

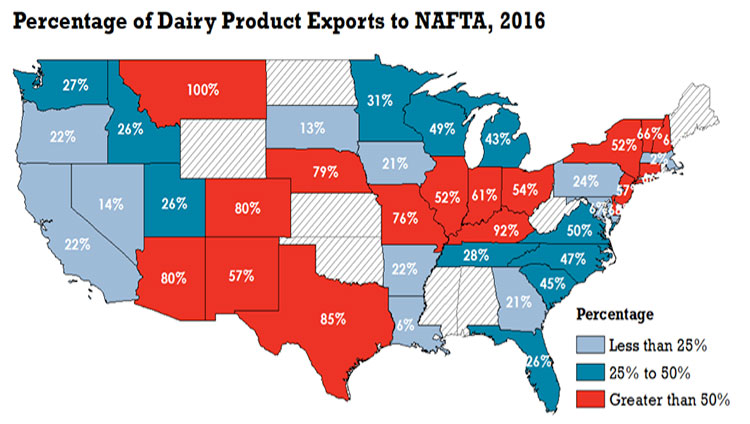

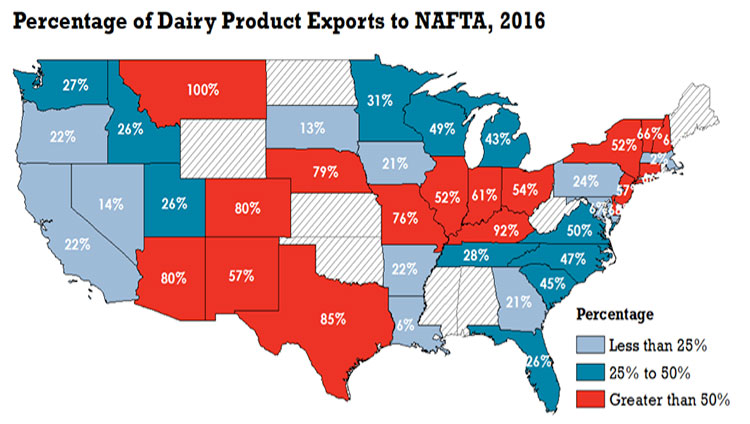

Farm Bureau's analysis indicates that agriculture in every state depends on NAFTA. It’s no secret the dairy industry would be hurt should the U.S. withdraw from NAFTA. In the short run, cheeses, butter, and other dairy products would build in inventory and push prices lower. In the long run, plants would likely evaluate their supply arrangements with producers considering higher tariffs and reduced market access — putting at risk many U.S. farm families.