The author is with INTL FCStone.

In theory, making the move from “price taker” to “price maker” seems simple and beneficial enough. Yet getting started remains a perpetual hurdle for many producers. I get it — hedging your dairy price risk can seem overwhelming, particularly when there are other — seemingly more immediate — issues at hand.

But let’s dial in a little deeper here. At the heart of the issue, many dairy producers really have misconceptions about risk, concerns about the cost of hedging, and fears of loss on hedging transactions.

LET'S GET STARTED

First things first. Start by asking yourself: What is it that I’m trying to accomplish?

An effective hedging program does not attempt to eliminate all risk — it attempts to transform unacceptable risks into acceptable form.

What is acceptable to you?

And what is unacceptable?

The challenge for you is to decide the business risks you are willing to bear and the ones you wish to reduce or remove by hedging.

TWO RISK CATEGORIES

I find it helpful to break down your business into two risk categories: operational and financial. Operational risks are all those directly associated with the daily production of clean, fresh, quality milk. While problems from a failed refrigeration compressor to a lack of available trucks are serious, they’re fairly straightforward. The financial risks are more elusive and so they sometimes get less attention, but they’re just as serious.

To understand financial risks is to first accept that you have them. Be willing to recognize that the dairy farm operator who does not take responsibility for his or her financial risks is really betting that the markets will either remain static or move in their favor. Ironically, speculation is another main hurdle to hedging.

NOT A DIRTY WORD

When it comes to markets, speculation is a dirty word. Many dairy producers do not hedge precisely because they automatically believe they’re speculating on the price of the commodity. They believe that using futures or options introduces additional risk.

In reality, the opposite is true. A properly constructed hedge lowers risk. Betting that the prices will arrive at — or above — your cost of production month-in and month-out is really the gamble.

Those who understand and are comfortable with hedging as the opposite of speculating may still struggle with the costs associated with hedging. Admittedly, some hedging strategies do cost money.

But consider the alternative.

To accurately evaluate the costs of hedging, you ought to consider them against the costs of not hedging. The cost of not hedging is the potential financial loss your farm can suffer if market factors move against your interests. So far, the first quarter of 2018 may be a stark example of this.

Next to costs, the failure to evaluate the performance of a hedge by the appropriate benchmark is a real problem. Much of this occurs due to widespread confusion over expectations. The key to properly evaluating the performance of all futures or forward-contracting transactions lies in establishing appropriate goals at the outset.

A WORKING EXAMPLE

If you sell 2 million pounds of milk per month and sell 50 percent of that production forward at 70 cents above your cost of production, then we need to be comfortable with those figures at the beginning and at the end of the hedge.

This is easier said than done. There are ways to make the hedge more flexible and profitable, but for the sake of this article, we want to be comfortable with the concept of marketing milk at a profitable level. You also need to be okay with the idea that you’re establishing a profit margin and removing price volatility — not trying to beat the market. Remember, trying to beat the market is speculation. A properly established hedge can secure a profit for your farm.

Market opinion, of course, is not a bad thing. In fact, as dairy market risk consultants, we spend a lot of time talking to buyers and sellers of dairy products about short- and long-term price direction based on supply and demand assumptions.

Although it’s valuable to get a sense of market tenor, many market participants fall into a trap of trying to construct hedges on the basis of their market outlook. The best hedging decisions are made when you acknowledge that market movements are unpredictable. A hedge should always seek to minimize risk first. It should not represent a gamble on the direction of market prices.

A well-designed hedge — one that considers the central aspects discussed above — reduces both risks and costs to your operation. Hedging stabilizes earnings, frees up resources, and allows you to focus on basic competitive advantages of quality and quantity of your products.

TAKE A LONG-TERM APPROACH

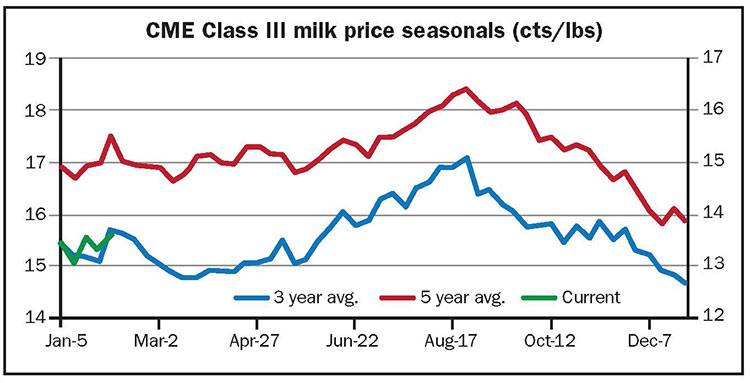

Writing this article on “how to lock in profit” as nearby 2018 milk future contracts are near the lowest levels in a year may be advice not so well received. But the milk markets are always moving around, and the opportunity to sell your milk at good, profitable levels may be here before you realize. We encourage you to use this time to familiarize yourself with the proper tools and temperament to approach hedging with a different — simpler — view.