Many of us “old-timers” in the industry still remember when whey was the nuisance by-product of cheesemaking. It has only been in the past two or three decades that whey has come into a world of its own.

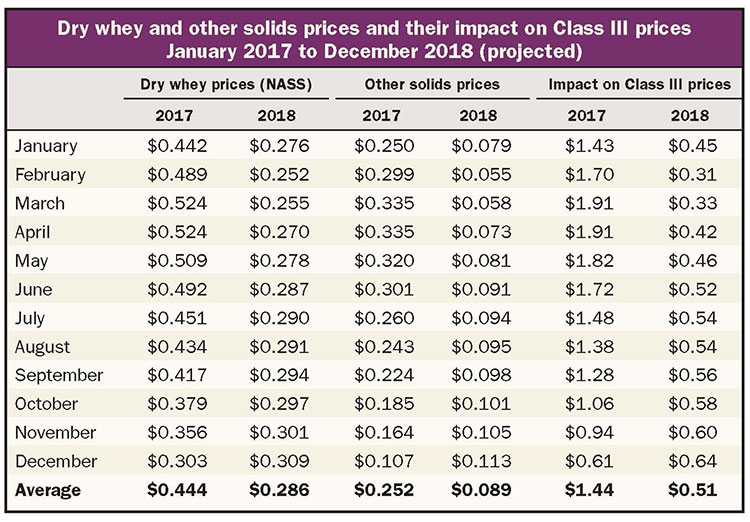

The table shows the movement of monthly average NASS whey prices from January 2017 through February 2018 along with forecasted levels through December 2018. National and international production of whey and whey products have climbed as cheese production grew in 2017. At the same time, demand for whey declined as countries like China backed off its purchases.

Sr VP of economics, communications, and legislative affairs, Agri-Mark Inc.

DRIVES OTHER SOLIDS

The price of whey has a direct impact on farm prices through the “other solids” component pricing in federal orders. The table also shows those other solids prices announced by the Market Administrators’ Offices of USDA. Federal orders use a direct calculation to get that component price. USDA subtracts the predetermined costs of making the dry whey from the NASS (National Agricultural Statistics Service) price and adjusts the difference by a small yield factor to get the other solids price.

The costs to make the whey is often referred to as the “make allowance” and is based on actual plant costs given at federal order hearings more than a decade ago. Its value is 19.91 cents per pound and the yield factor is 1.03. If you subtract about 19 cents from the whey price, you can estimate the other solids price.

This “make allowance” can also result in negative prices for other solids if the dry whey price is determined to be below 19.9 cents per pound. This happened in several months in 2003, 2008, and 2009 when farmers received a deduction from their milk checks for the negative other-solids value. Fortunately, this has not happened since 2009 . . . although we fell dangerously close to that situation this winter.

The other solids price was about 50 cents per pound in July 2014 and was a significant factor is driving farm milk prices to record levels. In 2017, the price peaked at 33.5 cents per pound in April but reached a low of 5.5 cents per pound in February 2018. Forecasts expect a small rebound up to 10 or 11 cents per pound by the end of this year, but any change in supply or demand could alter that.

FACTORS INTO CLASS III

The impact of whey and the other solids prices on Class III prices is also shown in the table. When calculating the Class III price, the federal orders use an other solids level of 5.7 pounds in the announced Class III price of a hundredweight of milk. This is much the same way that they use a butterfat level of 3.5 pounds in that same announced price.

Those 5.7 pounds of other solids enhanced the Class III price by $1.91 in April 2017, but did so by only $0.31 in February 2018 due to lower whey prices. That impact on the Class III price was the major factor in why the Class III price was $15.22 in April 2017, but only $13.40 in February 2018. Whey values can have a huge impact on Class III prices and farm milk prices, and they have in recent years.

A LEADING PROTEIN

We live in a severely protein deficit world where literally hundreds of millions of people do not consume the levels of protein needed for healthy bodies and lifestyles. Dairy protein has proven to be one of the best forms of protein available. Whey products are highly digestible and desirable as can be seen by their growing use in elderly nutrition, baby formula, and even bodybuilding products. Hundreds of products in your grocery store, from soups to hot dogs to face creams, include whey products.

While the potential market for whey products is much greater than current production, it remains limited by the income of those people most needing it. As incomes grow and countries decide to provide better food for their populations, that whey demand will be realized. It’s only a matter of time.