One out of 7 — on one day of each seven-day week, every U.S. dairy cow produces milk for the international market.

One out of 4 — Mexico buys 1 pound out of every 4 pounds of U.S. dairy product exports.

The math is that simple.

Mexico is America’s No. 1 international dairy customer.

Tariffs may be coming

President Trump placed new tariffs on steel and aluminum imports from Canada, Mexico, and the European Union in late May. On top of this, Trump’s team is considering levies on cars and auto parts. The targeted move was meant to bring trading partners back to the negotiating table to discuss economic concessions.

In politics, every action comes with a reaction. Unfortunately, that reaction could involve dairy and a host of other agricultural products.

Various cheese, pork, berries, grapes, and apples could be tariff targets by Mexico “up to an amount comparable to the level of damage” as a reaction to U.S. on steel and aluminum tariffs, stated Mexico’s Economy Ministry.

For cheese, that could involve Cheddar, Gouda, and other products.

That’s a big deal to U.S. dairy farmers already struggling with very tight or even negative margins.

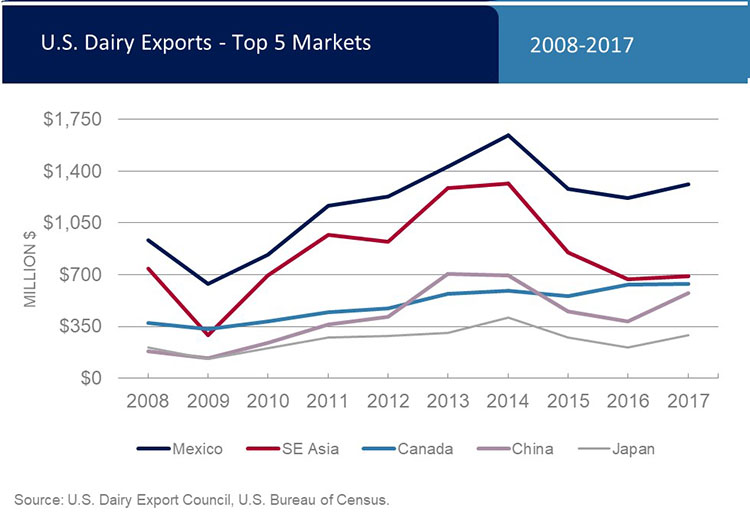

In 2017, Mexico accounted for $1.3 billion of America’s $5.4 billion in dairy product exports.

Canada a concern, too

America’s neighbors to the north, Canada, collectively purchased $636 million in dairy products last year. That accounted for 12 percent of all U.S. dairy exports.

Between Mexico and Canada, $1.95 billion or 36 percent of U.S. dairy exports are now at risk if a trade war ensues.

As for the European Union, it did not rank among the top 10 of U.S. dairy customers. Of the top 10, that group collectively accounted for 87 percent of global U.S. dairy product sales.

Will it help steel?

Mexico only accounted for 9 percent of finished steel products and 11 percent of semi-finished steel. Given those sales, dairy could be a bigger loser in lost export sales than the U.S. market would be in a gain for U.S. steel milling jobs.

Canada is different.

That country accounted for half of the raw aluminum imported by the U.S. and 21 percent of the finished steel.

Bottom line: Now that U.S. dairy export markets have been risked, every dairy farmer should think seriously about contacting their respective national leaders before we collectively take another hit on our milk checks.