When talking about dairy products, cheese, fluid milk, or butter would probably be among the first products mentioned by most people. Butter, yogurt, and ice cream would be in the conversation somewhere. And when we begin talking about important products for balancing product inventories or export, skim milk powder would certainly be in the mix.

But who talks about whey?

When cheese is made, about 12 percent of the original volume of milk is in the cheese. The remaining 88 percent is the liquid whey. The whey itself is about 93.5 percent water, but the remaining 6.5 percent of solids are composed of fat, whey proteins, lactose, and minerals. The whey is almost always separated to remove as much fat as possible, and often a “fines separator” is used to remove the very small particles of cheese curd. What is left are the whey proteins, lactose, minerals, and water.

Whey weighs up

U.S. manufacturers produce about 1 billion pounds of dry whey and another half-billion pounds of whey protein concentrate (WPC) and whey protein isolate (WPI) annually. About half of all whey products are exported to other countries, primarily China and Mexico. Export sales to these and other countries ultimately become an important determinant for our farm milk price.

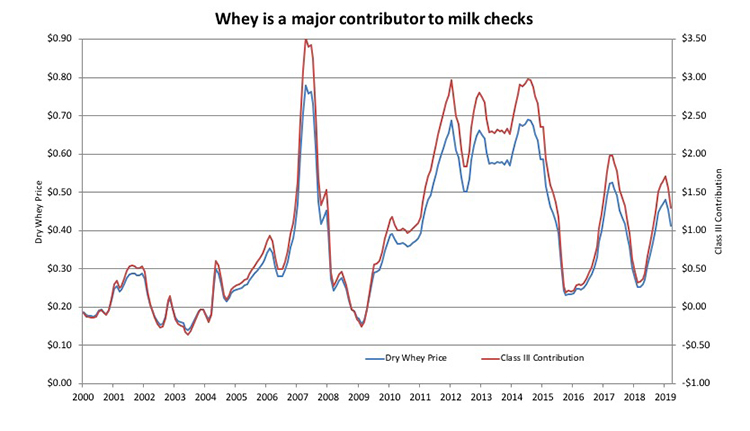

Nearly all U.S. dairy farmers are paid for the components in milk. The milk components are butterfat, protein, and other solids. It is the whey prices, captured in the weekly National Dairy Products Sales Report, that determines the value of “other solids” in our milk checks. Most of the value of our milk check comes from butterfat and protein, but the other solids can be an important contributor, too.

The graph shows that dry whey prices can be quite volatile ranging from about 20 cents per pound to more than 60 cents. By the time these values are used in our Federal Milk Marketing Order pricing formulas, the contribution to your milk check goes from close to $0 to more than $3 per hundredweight.

Recent trade woes

Export sales of whey to China have been a problem due to retaliatory tariffs during trade negotiations between the U.S. and China. But we are also concerned that they could continue to be a problem even if a trade deal was reached. A great volume of our whey sales are fed by pork producers to the swine herd in China and other countries. But, as the swine herd is being threatened with African Swine Fever, there is concern that it could take a long time for whey to return to peak demand levels.

A world leader

Whey may be our forgotten product, but the U.S. is the largest whey producer in the world. It is important to remember that whey prices do have a significant impact on our farm milk checks.