ASSESSING FINANCIALS

Many business and personal aspects determine a farm’s risk position. Perhaps the most straightforward is the financial position. Using accrual adjusted income statements and balance sheets at market values, dairy farm managers can assess the solvency and liquidity position of the operation. Not only is this information useful for evaluating performance, but it is also closely related to the metrics that lenders use when evaluating credit risks and determining loan viability.

There are many measures of solvency, but they all measure the relative amount of equity on the farm. Since asset value less debt equals equity, knowing any two of those values means we know the third.

One ratio that indicates solvency position is farm debt-to-asset value — again, most accurate with assets valued at market rate. This is the share of the farm assets that are owed to a lender so that larger values indicates more risk of insolvency.

In recent years, lenders have wanted this value to remain below 60 percent with some desiring below 50 percent. The closer the farm values are to this level, risk management activities to assure that extra debt is not required are even more important.

Similarly, liquidity can be measured in many ways, but the primary issue is having funds available to pay bills. The current ratio is defined as the value of current assets divided by the value of current liabilities.

Current assets are those that are cash or can easily be converted to cash, including crop and feed inventories and market livestock. Current liabilities are those debts that are due in the next year, including accounts payable, operating loans, and the current portion of term debt.

While a farm could also sell intermediate or long-term assets to pay bills, selling those assets has negative implications for future production. A higher current ratio indicates that more assets are available to pay debts. Values below 1 mean that there are insufficient assets at that current time to pay debts that will come due and accommodations — such as an operating loan — will likely be necessary. Lenders would like to see the current ratio be 2 or higher.

However, keep in mind that there are opportunity costs to carrying too much liquidity. That is, holding extra liquidity will help with any unexpected bills but at the cost of using those funds in potentially profitable investments. Again, the less the current ratio, particularly if it is approaching 1, the more important it is to minimize the likelihood of a shortfall that will stress the farm business.

Using these solvency and liquidity measures, farm managers can assess how much they can afford to borrow until they hit the trigger or whether they might need to generate more liquidity. This information is useful in understanding the ability of the farm business to absorb a poor year in terms of milk and/or feed price. Assessing farm financial position does not reveal the desired action. However, it may indicate that risk management is required.

RISK EVOLVES WITH AGE

The goals of a farm market and price risk management program will depend on many factors specific to the farm management team and farm financial situation. Personality, age, and preferences affect risk management goals.

Risk attitude can change over time and with the amount of money involved. As retirement approaches, people tend to get more conservative with their financial decisions as less time is available to recover from a disaster.

Past experiences also influence risk preferences. Those farm managers who lived through the recession and farm crisis of the 1980s often have a very different perspective than those who began their careers in recent decades. Taken together, farm financial situation and risk preferences can assist in setting goals. Goals might include maximizing returns in the worst-case scenario or assuring a minimum return to cover required expenses.

TOOLS YIELD THREE OUTCOMES

Numerous risk management tools are available, but they generally do at least one of three things:

- Reduce adverse outcome impacts

- Improve risk bearing capability

- Maintain flexible decision-making

Insurance and government programs are tools that reduce impacts. Maintaining liquidity and credit access improve risk bearing capability. Spreading out marketing maintains decision flexibility.

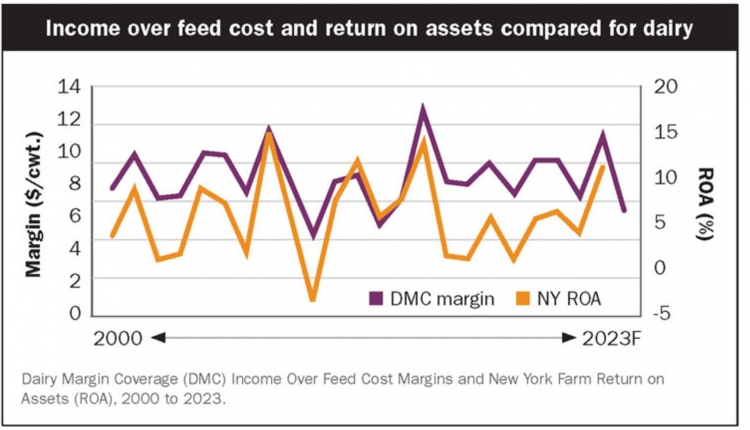

Sign-up is currently open for the Dairy Margin Coverage (DMC) program. We know that 2019 will result in DMC payments that will more than cover premiums at coverage of $8.50 per cwt. or more. If a farm can cover 5 million pounds of actual production history at $9.50 per cwt., the payments are presently forecasted to be about $20,000 net of premiums.

Thus, one approach to risk management at the current time is for dairy farm managers to assess the potential assistance from DMC and determine whether more protection is required or desired. If so, then Dairy Revenue Protection, Livestock Gross Margin for Dairy, cooperative tools including forward contracts, as well as futures and options can complement existing risk management activities.

Finally, assessing results of risk management programs can assist in adjusting goals and expectations. One issue with evaluating the performance of risk management is that the actions are always “second-best” in the sense that if, for example, milk prices fall, then more should have been done, and if milk prices improve, then the cost of the risk management was for naught.

Regret is a powerful emotion. Psychologists have found that people often prefer to do nothing and have something bad happen than take an action with the same outcome. However, consider that not making a risk management decision is making the decision to not be protected.

The long-run goal of risk management programs may be to minimize the likelihood or consequences of poor economic returns. Doing so will mean that cost will be incurred and sometimes returns may miss the top of the market. The extent to which this trade-off is acceptable depends on the farm manager’s goals and preferences.