The author is a professor of agriculture, food, and resource economics at Cornell University.

Much has been made of greater milk component production in recent years, and for good reason. Advances in cattle nutrition and genetics have enabled higher component production, with milkfat in particular rising in the past decade. The incentive to grow components sold comes not only from higher revenues but also lower costs of hauling and marketing, which are based on hundredweights of milk regardless of component levels.

Figure 1 displays the total consumption of milkfat and skim solids per person in the U.S. from 2011 through 2023. Over that period, skim solids consumption rose by 1.6% from 516 to 525 pounds annually, while milkfat consumption climbed by 9.6% from 603 to 661 pounds annually. Over the same time period, the U.S. population grew by more than 21 million people (314 to 335 million). The result is that total domestic consumption of milkfat grew by 16.9% and total domestic consumption of skim solids bumped up by 8.4%.

Different products

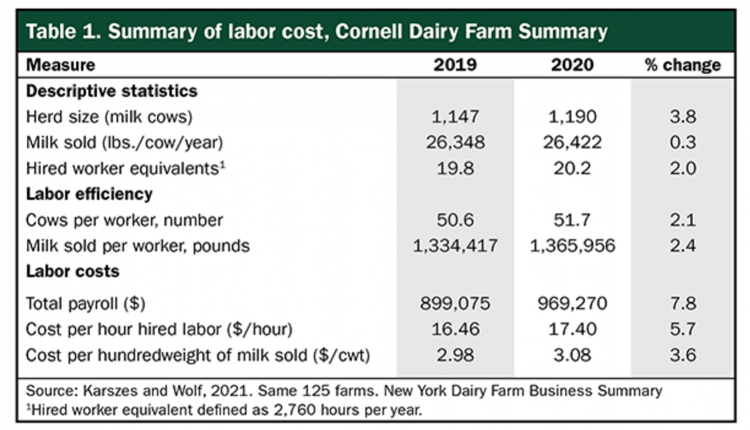

As milk components are combined in different proportions to make a wide range of dairy products, consider which products were the primary drivers of the consumption trends. The single largest user of milkfat and skim solids is also the largest dairy product category —cheese (Table 1). Butter is the second largest user of milkfat, while fluid products are third.

Prior to 2005, fluid products used more milkfat than butter, but the consumption of lower fat content beverages, declining beverage milk consumption, and more butter consumption led to butter passing beverage products. While cheese is the largest user of skim solids, fluid products are close. Whey and dry dairy products (such as nonfat dry milk) combine to use more than one-quarter of skim solids. Trend-wise, cheese and butter are increasing users of components while fluid and frozen products are declining.

Per capita cheese consumption surpassed 40 pounds for the U.S. in 2023. While this was an all-time high, there are many countries that consume considerably more cheese. Switzerland, in particular, consumes about 52 pounds of cheese per person annually.

Where do we sell it?

The longer term trends are greater per capita consumption of milkfat and flat consumption of skim solids, with population growth driving the total. As milkfat and skim solids are joint products, they must both find markets. For the most part, the U.S. has consumed the higher output of milkfat domestically as butter, creams, and other full-fat products. Balancing the skim solids production has relied on export markets.

The U.S. has been competitive in world markets for the past couple of decades and, not coincidentally, exports have grown. In 2023, the U.S. exported about 22% of the skim solids produced, primarily in the form of dry products, whey products, and lactose. Milkfat exports in 2023 accounted for less than 5% of production as domestic markets provided strong demand.

The reliance on exports to balance skim solids is the reason that the trade outlook is key to farm milk price. The U.S.-Mexico-Canada Agreement (USMCA) resulted in more access to Canadian markets. The USMCA is up for review, and dairy considerations are likely to be front and center. In recent years, the U.S. has fallen behind the EU and New Zealand in new bilateral and multilateral free trade agreements and must make up lost ground to ensure competitiveness in international markets.