Could dairy’s “V-shaped” price recovery transcend into a “W-shaped” price downturn?

If shifted from a “V” to a “W-shaped” milk price graph, the markets would face a second downturn fueled by oversupply of milk, lighter dairy product demand, or a combination of both market metrics.

“We are not out of the woods on that yet as one looks to the fall and potential milk prices next year,” stated Jim Mulhern, CEO of the National Milk Producers Federation (NMPF). “The last thing we need is a big increase in milk production.”

Culling down three straight months

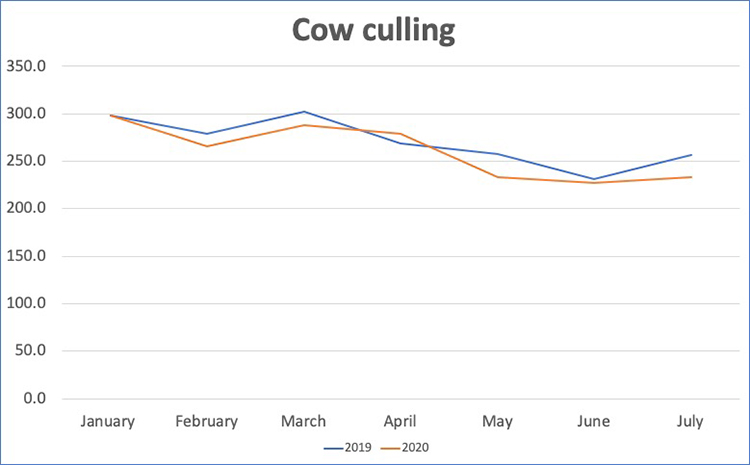

Slowed dairy cow culling could be a harbinger of more milk headed into the pipeline. Even with supply restrictions imposed by many of the nation’s dairy co-ops, dairy farmers are culling fewer cows. From May to July, 52,100 fewer dairy cows were sent to packing plants when compared to the same time last year.

July posted a 23,100-cow reduction, while May was off 24,100 head, according to USDA’s Livestock Slaughter. A full comparison can be seen in the graph.

When looking at another dataset, the nation’s dairy cow herd has been holding rather steady between 9.35 million and 9.36 million dairy cows during the May-to-July window, according to USDA’s Milk Production. However, slowed culling could soon cause cow numbers to build.

Why the concern?

“Post-lockdown dairy demand is both fantastic and terrible,” explained Nate Donnay in his Hoard’s Dairyman Intel “Could milk supplies overwhelm the market?”

It is fantastic because retail sales of natural cheese are running strong . . . still up 12% to 13% from last year through the first half of August.

It is terrible because food service sales are still down 15% to 20% during the same time.

Moving forward, government purchases, which are up over 2,000% because of those COVID-19-induced purchases, will soon come to an end without a renewed budget approved by Congress and the president.

Also, exports were up 33% in June, largely due to pitiful dairy prices in the preceding months due to COVID-19. It’s doubtful exports can keep up that pace.

As Donnay notes, “If you narrow the data to just domestic purchases, removing exports and government purchases, then the demand numbers look pretty terrible, down 3.5% from last year in June.”

With cheese prices well above world levels and the pandemic not easing its grip on the economy, more milk from the collective U.S. dairy herd this fall would be devastating to milk prices. The conditions do appear to exist for both lighter dairy product demand and more milk in the coming months, and that could cause a downturn in milk prices.