Negative PPDs, or Producer Price Differentials, have been a story this summer and likely will continue well into the fall. The simplest explanation for negative PPDs is that we have paid out more in value of the Class III components than we had in the Federal Order pool and to balance, we calculate a PPD as the residual value.

The negative PPDs can arise from rapidly rising prices when Class I calculations — which are usually larger than Class III — lag behind. Or, they can be negative because of a large difference between Class III and Class IV prices when Class III is the higher price. The average of these two manufacturing prices determines the skim milk value for the Class I base price.

We might well ask, “Why are the Class III values so high?”

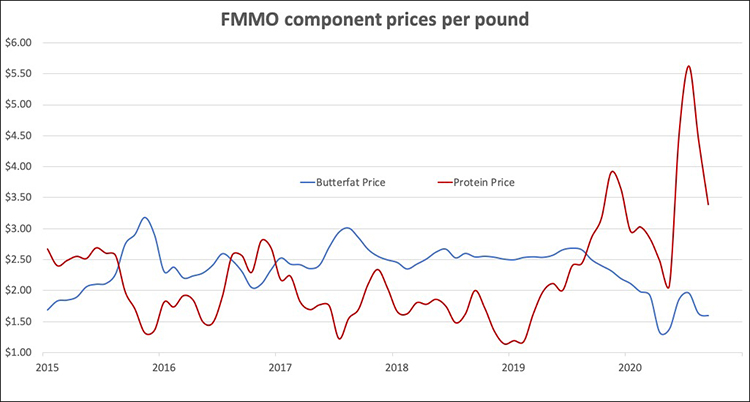

The chart shows that the butterfat price isn’t the culprit. The butterfat price is determined by a product price formula directly from the monthly average butter prices in the National Dairy Products Sales Report, and those prices have been lower than in recent years. The culprit is the very high protein prices.

Protein prices move to new records

If you look at your last few milk checks you will see that the protein price for your June milk was $4.5349 per pound. And in July and August, it was $5.6294 and $4.4394, respectively! We’ve never had prices like that before.

The protein price in your milk check is also calculated from a product price formula. This formula takes the monthly average price of cheese in the National Dairy Products Sales Report and subtracts the butterfat value from it to estimate a protein value.

Very high cheese prices (the CME spot market hit $3 per pound on July 13) subtracting lower than typical butterfat values have yielded very high protein prices. That, in turn, has caused us to pay out more in Class III component values than we had in the federal order pools.

Indeed, 2020 has turned out to be a very strange year in so many ways. High protein prices and negative PPDs are just a couple more examples that we can talk about in dairy circles.