There is no question that dairy prices have recently walked through levels of uncertainty never realized or equaled in our lifetime. On a month-to-month basis, Class III prices routinely swung $5 per hundredweight (cwt.) or more during the 2020 calendar year. The lack of price stability has become a foregone conclusion.

Dairy markets faced a number of unique impacts. Food box buy ups injected new life into fading prices with each new round of announcements. The discussion of negative producer price differentials (PPDs) took on a life of its own and swung to levels never before imagined.

In the wake of a federal election, USDA-sponsored buying programs appear to be sunsetting, reducing domestic cheese purchases. At the same time, new cheese production capacity is ramping up, milk production is on a tear, and price volatility is still very much alive . . . albeit trending in a new direction.

ever.ag Insurance Services

The month of November started off with all the optimism that carried dairymen through the darkness of a newly charted, COVID-interrupted path. Block cheese prices reached as high as $2.78 per pound in the CME spot session, while Cheddar barrels set new record highs at that same time of $2.53 per pound. Class III prices in the December contract peaked out the week prior at $21.16 per cwt.

By the end of the month, blocks were more than a dollar lower, barrels fell to $1.40 (a price not seen since August), and Class III December futures were hovering just north of $15.50 per cwt.

What happened?

Very suddenly, the demand for fresh cheese product dried up. A market that saw ongoing deliberate daily bids for product evaporated overnight and left the very few sellers scrambling to clean out any and all uncommitted product. Price movement traveled the razor’s edge, leaving participants with much more than a little rash.

While nearby futures contracts were defined by unprecedented volatility, more deferred pricing opportunities in the 2021 calendar were a bit more stable. In the time spent pressuring the $5 drop in December futures, the Class III price average for the first quarter (Q1) of 2021 dropped just 80 cents from its early November peak. Second-quarter 2021 Class III prices actually rallied higher while these others were falling. The same was true in the back half of the year. This is where perspective comes into play.

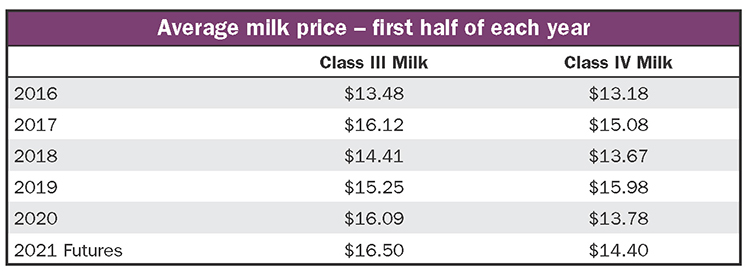

If we are to assimilate back to what I dare call “normal,” one should respect what is normal for the first half of any new calendar year. Again, maintaining Class III as the benchmark, the period of 2016 through 2020 has witnessed first-half price averages as outlined in the table based on USDA data.

The best year since 2014?

If futures prices as outlined in the table should stand as they are today, they will serve as the single best outcome the period has witnessed going back to 2014. Now consider what we know . . . or what we don’t know.

- Milk production has been carrying a pace unequaled since the 2017 U.S. production year.

- Will greater self-imposed quota restraints clamp down again in 2021?

- The ramping of the new cheese plant in St. Johns, Mich., will bring added cheese to the market. Will this add significantly to current inventories?

- A new president is about to take office. Will there be significant policy change? Will there be an extension of food buying programs?

- Consumer demand flows are still very much interrupted with retail making offsets in some product categories to the losses in food service. Will this return to pre-COVID flows anytime soon . . . if ever?

- Prices are moving back into alignment with world prices. The U.S. dollar is comparatively at the lowest levels witnessed since 2018. Will exports pick up to offset potentially greater milk supply or growing product inventories?

The big picture

Perhaps there are still more questions than answers. Maybe what we don’t know outweighs what we do know. However, price is always the focal point. We can talk very plainly and very absolutely about this number. Very plainly and very absolutely, today’s first half 2021 Class III futures values are better than any outcome witnessed since the last big run in price in 2014. So, how are you managing that?

Risk management is nothing more than accepting the uncertainty of our future and then moving beyond that acknowledgment to build levels of certainty into your revenues, costs, or margins.

Several tools exist to help build certainty around a very uncertain, constantly volatile milk price. Between Dairy Margin Coverage (DMC); Dairy Revenue Protection (DRP), available through licensed agents; futures and options (the foundation of all products available in the public marketplace); and buyer-specific forward pricing programs, your toolbox of solutions offers plenty of variety.

Opportunity is indeed knocking.

Will you answer the door?