The author is chief marketplace officer for Farm Credit East, ACA.

Agriculture, and dairy production in particular, can be a risky endeavor. There are many types of risks, and they can generally be put into one of five categories:

- Production risk: This is any risk that could affect production of milk or crops. In this category are things like herd health on the milk side and weather for feed production.

- Marketing risk: These are risks related to marketing your output, which could include the stability of your relationship with your milk buyer, as well as price risk due to fluctuating markets.

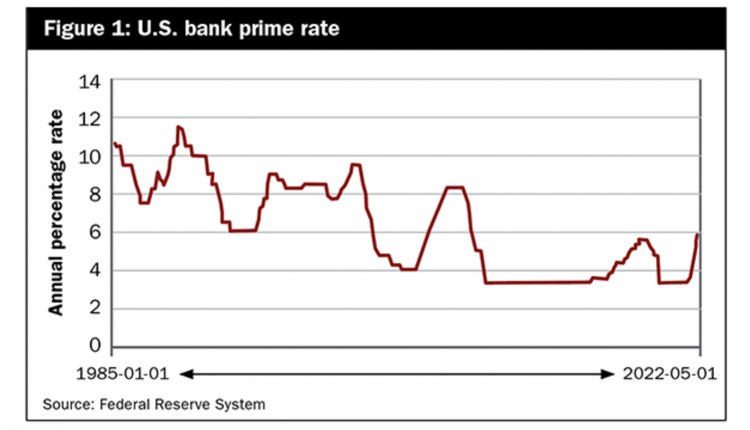

- Financial risk: This involves risks that could affect the financial health of the enterprise, including the ability to borrow funds, meet cash flow needs, deal with short-term setbacks, and build long-term equity for reinvestment and personal goals such as a secure retirement.

- Legal risk: This could include a broad range of risks in areas such as liability, safety, contracts, human resources, and regulations.

- Human risk: This relates to the need to keep those involved in the business, particularly the ownership, healthy and productive. Sometimes we refer to the “five D’s” of human risk: death, disability, divorce, disagreement, and disillusionment. Any of these can have a devastating effect on a business enterprise.

The risks overlap

There is certainly a great deal of overlap between these five categories, and some risks cross over several of them. Still, this categorization can be a useful way to think about your business and personal risk management strategies.

In future articles, I will address all of these risk categories. At the moment, I will focus on category number one — production risk. Most dairy farms do a good job looking after their milk production, but many leave money on the table by not maximizing their quality premiums. Depending on your market, they could add up to 35 to 50 cents per hundredweight (cwt.). Raising high-quality forages also can lead to enhanced profitability and lower purchased grain bills.

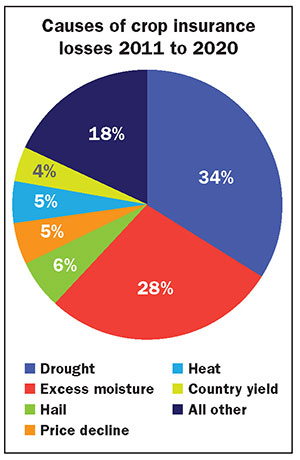

As we all know, weather can have a tremendous effect on crop yield and quality. If you have a year with unfavorable weather, you will likely have to deal with lower feed quality and need to purchase a greater amount of feed to supplement your own harvested crops. If the poor weather conditions are widespread, others will be in the same situation, which means shorter supplies and likely higher prices for feed.

In the Northeast, many producers are facing this situation: 2019 was too wet, 2020 was too dry, and we’re seeing a significant rally in grain and oilseed prices. This means that in addition to milk price risk, producers are facing substantial feed price risk as well — typically the most costly expense item.

Thankfully, there are some useful government programs to insure the crop side of your operation. Row crops such as corn grain, silage, soybeans, and more can be covered with crop insurance. These tools help to protect against fluctuations in yield, quality, and prevented planting due to natural causes such as adverse weather conditions. Accurate yield records are required.

Pasture and hay forages can be covered with Pasture, Rangeland, Forage (PRF) insurance — a vastly underutilized crop insurance tool. This policy can protect the farm when there are shortages of precipitation causing a decline in the area hay or pasture yields. Signing up for Agricultural Risk Coverage (ARC) or Price Loss Coverage (PLC) through the Farm Service Agency (FSA) also can provide additional crop revenue support to the operation. The chart details the many risks farmers face as mentioned earlier, with drought and excessive moisture topping the list at 34% and 28%, respectively.

Steps to self-insure

Many farmers choose to cover this risk by building a four to six month feed inventory carryover, allowing them to “self-insure” against a poor crop yield. This strategy could allow the operation to develop additional revenue by selling off the excess crops in the form of shelled corn, extra hay, and so forth. You’ll need to know your break-even cost per acre when calculating whether to grow additional crops for sale. This idea also may fit well if your plan is to milk fewer cows to stay under a production base limit from your milk market.

Another production risk variable is the quality and amount of replacement cattle on the farm. Having 100% of the herd size in replacements allows for growth without having to purchase outside animals and could be a buffer should a herd health issue arise. However, raising only the replacements you need may allow for fewer crops to be grown or possibly extra feed to sell for additional income.

Have a conversation

Producing high-quality forage is one of the keys to a profitable dairy, and utilizing risk management tools can help reduce the impact of adverse weather. Adjusting the number of replacements raised may also be a consideration. It’s always a good idea to discuss these options with your team of advisors first, though, including your loan officer, crop insurance agent, nutritionist, and veterinarian.