The author is chief marketplace officer for Farm Credit East, ACA.

In my April 25, 2021, column titled, “Keep an eye on the five major farm risks,” I introduced the “Five categories of risk” that farmers face:

- Production risk

- Marketing risk

- Financial risk

- Legal risk

- Human risk

We discussed production risk. This includes the risks involved in growing crops and managing livestock. In June’s article titled, “How secure is your milk market?” we talked about marketing risk. How and to whom your milk is sold is a key part of a dairy producer’s business strategy.

In this article, we’ll address financial risk, our third category. Managing financial risk is really the culmination of managing all other risks. Eventually, having a viable farm comes down to the dollars and cents and making sure you can pay your bills. The capital-intensive nature of farming and the volatility of prices, yields, markets, and income, coupled with debt service and other factors, make financial risk one of the most important risks to consider.

Know your numbers

Managing your financial risk begins with having good financial information. It’s imperative to have a solid record keeping and accounting system in order to glean accurate and timely information on your business. You should have beginning and ending balance sheets that reconcile and allow you to make accrual adjustments for things like feed inventory, prepaids, and deferred revenues.

The decisions you make can only be as good as the information you base them on. If you don’t have a good system for financial record keeping and management information, you’re essentially “flying blind.”

Having good financial information is a key starting point, but the next step is sharing that information and getting feedback and input. Many farmers are reluctant to share financial information, and some degree of confidentiality and discretion is certainly warranted.

But periodically, it’s a good idea to bring in key advisers, share information with them, and use them as a sounding board. This might include family members or partners and top managers, as well as outside advisers like your lender, accountant, or other major business partners. The people who are essential to your business should know how things are going so they can support you in achieving your short- and long-term goals.

Maintaining good financial records are required for tax filings, but they also mean much more. Successful businesses in dairy and across other industries use up-to-date and accurate financial information as their road map for success. Your financial picture is much more nuanced than what you pay in taxes and the balance in the checkbook.

Being successful in farming, and in business, requires understanding what’s going on with your crops, animals, and financials, and then making the best decisions you can. Knowing your costs on an accrual basis can help you make smart business decisions on both a day-to-day basis, as well as when you’re thinking long-term.

Be strategic

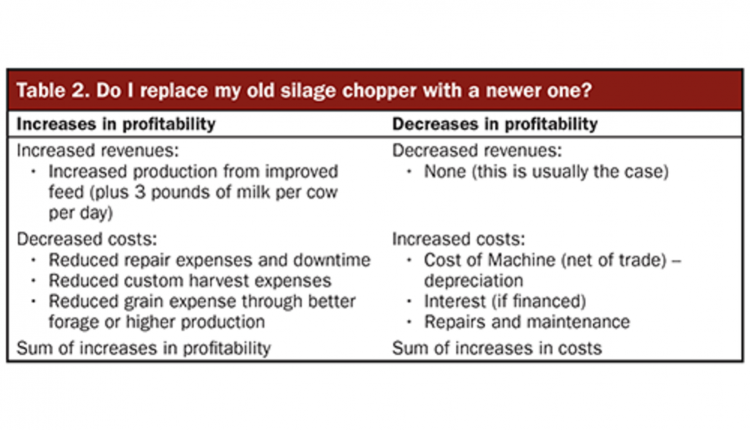

As you make decisions on spending and capital investment, try to think strategically rather than reacting to short-term crises and needs. It’s easy to succumb to a reactionary mindset where you respond to the problems that seem most urgent at the time. However, it’s important to step back periodically and make some higher level strategic plans for where you want your business to go.

When a piece of equipment breaks down, you might instinctively move to replace it, and that may, in fact, be the best course of action. However, it’s better to have a longer term plan for your capital spending and prioritize your investments according to your vision for the business.

Lenders should know you

Another key move to manage your financial risk is to cultivate a positive relationship with a lender who understands agriculture and your business and who is in it for the long haul, just like you. Don’t view a loan simply as a transaction but rather as part of a comprehensive plan to manage investments, liquidity, and cash flow for the long term.

Don’t wait for an urgent need to discuss your finances and credit options. Early discussions will help you plan beyond “putting out fires” and help you build equity for your business and your family.

Managing your revenues and expenses as well as your balance sheet and lines of credit to maintain adequate liquidity for your business will both enable you to make smarter, more strategic decisions and to sleep better at night. For more on this concept, read my January 25, 2021, article, “Liquidity is essential in turbulent times.”

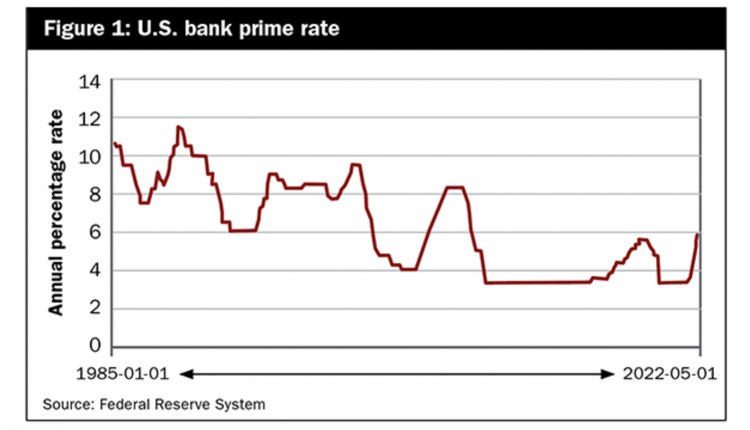

Some other things that can be done to manage financial risk include hedging or insuring your inputs and outputs. We are now in a period when input costs are rising, with substantial risk to the upside, and when milk and livestock prices are volatile, with downside risk. This convergence could potentially squeeze margins significantly.

Use the tools

Thankfully, producers have a number of avenues to manage these risks. As is mentioned frequently in this publication, federal crop insurance and Farm Service Agency programs like Dairy Revenue Protection (DRP), Dairy Margin Coverage (DMC), and Livestock Gross Margin Insurance (LGM) offer affordable ways to ensure revenues and margins. Take advantage of them. Many cooperatives and brokers offer commodity hedging services, which may allow you to put a floor under your milk price or otherwise limit your market exposure.

Financial risk also involves managing your leverage and equity position. Not “borrowing your last dollar” will keep you in a position both to weather industry downturns and to make strategic investments when the time is right. This is better than constantly dealing with short-term cash flow headaches.

Perhaps the best way to manage your financial risk is to know and understand the economics of your farm, manage your cost of production in a way that is sustainable in your market, and know where you stand in comparison to peer farms. There are a number of benchmarks and consulting services available to help you make meaningful comparisons between your own operation and those of others, to see where you’re doing well, and where you might have room for improvement.

Finally, and we’ll talk more about this when we cover the final risk factor, human risk, be sure to have a transition plan for your farm. Regardless of your age or stage of life, this is something you need to plan for.

What are your long-term goals for yourself, for your family, and for your business?

Are you able to build the financial strength to support a transition to the next owner?

Diversifying your investments to include some nonfarm assets may help you equitably treat those family members not involved in the farm operation in your estate plan. This strategy may also partially fund your own retirement to give cashflow relief to the next generation buying your farm. These are all important considerations and often need decades to implement, so we shouldn’t put them off.

Don’t push the pile

There’s a lot to think about here, but financial risk is one of the most significant and most critical risks for any farmer to manage. Some of this long-term thinking is easily put off, shunted to the “important, but not urgent” pile on your desk, while you focus on more immediate problems. However, it’s imperative to take the time, on a regular basis, to really look at your numbers and do some strategic thinking if you want your business to grow and thrive.