The volatility that dairy markets have experienced over the last several months continues. That’s because the balance between milk supplies and domestic and international demand for dairy products is precarious, making it difficult to confidently project future milk prices. Additionally, there have been large events outside the dairy industry that have led to market participants facing even more uncertainty.

There are signs that the structure of the dairy industry continues to evolve in ways that will only amplify milk price volatility. Domestic milk supplies respond quickly with more milk in periods of profitability, while milk supplies rarely move lower when there is a lack of profitability. It would appear that milk supplies are much more inelastic in periods of low profitability, thereby further elevating milk price volatility relative to the past.

Perhaps the best approach in forecasting milk prices is to first identify the major drivers of future milk prices. Although these significant drivers appear to be in better balance than in the recent past, a wide range remains around future milk prices. The drivers of milk prices have not changed appreciably . . . domestic milk supplies, domestic dairy product demand, and international dairy product demand remain the significant areas determining milk price movement. Forecasts that miss the mark in any of these categories, even by relatively small amounts, will likely lead to poor price projections.

Domestic milk growth slowing

The September USDA Milk Production report gave some positive news for milk prices, provided that the trend in the August data continues. The 19,000 head reduction in the U.S. cow inventory from July to August 2021 was the largest since September 2018. This is the third consecutive month of declining dairy cow inventory. August milk production grew by 1.1% versus a year ago, with the smallest monthly average gain since June 2020.

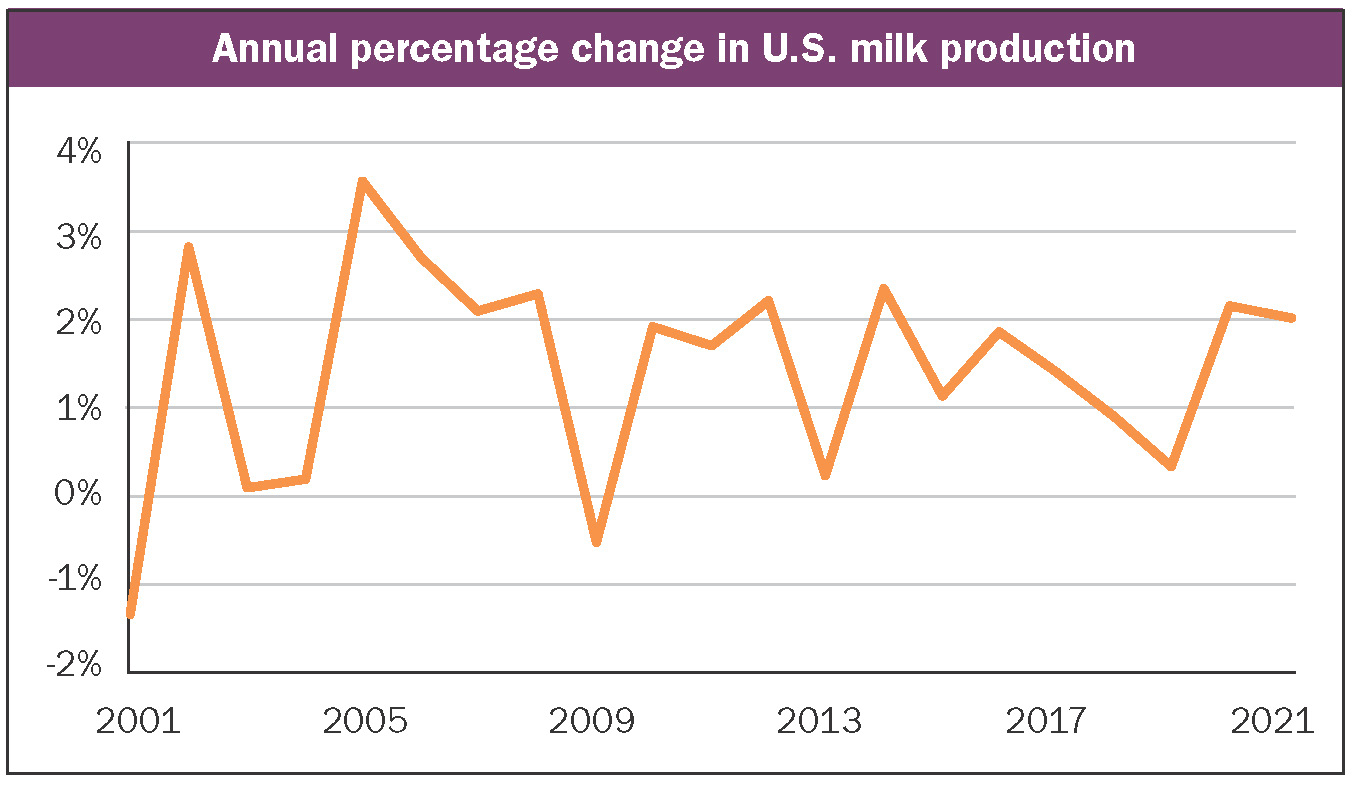

The figure shows that annual milk production growth will exceed 2% for the second consecutive year once 2021 comes to a close. Years of milk production growth in excess of 2% shown on the graphic have typically been accompanied by falling milk prices.

Although the recent USDA monthly outlook has reduced the 2021 to 2022 crop year prices for corn and soybeans, they are projected to remain above recent historical levels moving into next year. Overall, feed costs have risen by more than 30% over the past year due to dry weather in some parts of the country and strong demand for corn and soybeans. These higher feed costs, coupled with the recent reduction in monthly milk production growth, will likely result in a slowdown of milk production growth in 2022 to less than 1.5%.

Exports are crucial

The value of U.S. dairy exports has been one of the important factors in milk prices movement. The figure found at the bottom of page 617 that in years like 2009 and 2015 . . . when the value of U.S. dairy exports falls by more than 20% from the previous year . . . the U.S. All-Milk price fell by a similar percentage. In years like 2004, 2007, and 2010, when the value of U.S. dairy exports grew by more than 40%, U.S. All-Milk prices rose by historically large amounts. The correlation between the percentage change in All-Milk prices and the percentage change in the value of U.S. dairy exports is strong at 0.84.

In looking ahead to 2022, it appears the value of U.S. dairy exports will grow as global demand continues to recover from the pandemic. However, sales to international customers could face some headwinds as other exporters show modest recoveries in milk supplies in 2022. Also, China remains critical to the outlook for U.S. milk powder exports in the coming year.

Domestic dairy product demand has been strong in 2021. American cheese consumption averaged nearly 7% above a year ago for the first seven months of 2021, even though the Food Box program created some strong consumption in 2020. Butter consumption has averaged 1% growth over the same period. Only fluid milk consumption has fallen in 2021.

The recovery in the U.S. economy from the pandemic continues. Still, the economy remains a source of uncertainty in 2022 as additional cases of COVID-19 this year have slowed recovery in some parts of the country. In addition, 2022 consumer spending remains unknown as federal stimulus payments likely move lower.

The combined effect of the expected supply and demand conditions for 2022 leads to U.S. farmers experiencing All-Milk prices that are unchanged to slightly higher in 2022 relative to this year. This forecast depends on slowing domestic milk supplies coupled with continued strength in export and domestic demand. If any of these projections fail to materialize, a different milk price path likely will result.

More robust export demand from countries such as China, or U.S. milk production growth of less than 1%, could push milk prices even higher in 2022. On the flip side, another year of 2% milk production growth could place downward pressure on milk prices in 2022.

From January 2017 through July 2021, the U.S. All-Milk price has averaged 12 cents below $18 per hundredweight if March and April 2020 are excluded. However, state-by-state results can be very different depending on how their milk is utilized.

Even if milk prices are higher in 2022, the bottom line for producers may move lower as price gains are offset by higher feed and labor costs.