The author is the director of dairy market insight with StoneX Group Inc.

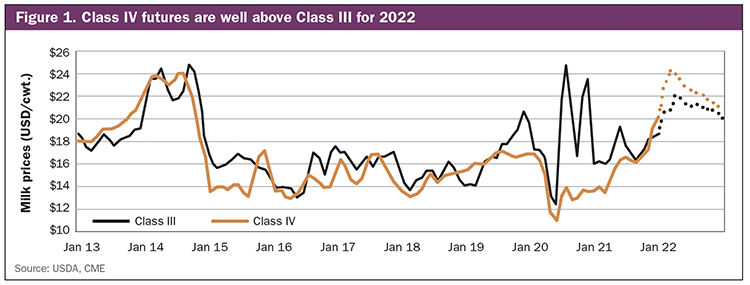

What I find interesting is that the market expects Class IV to average higher than Class III. If this comes to fruition, this would be the first time we’ve seen that unfold since 2013, and that is going to benefit some regions of the U.S. more than others.

The milk-price recipe

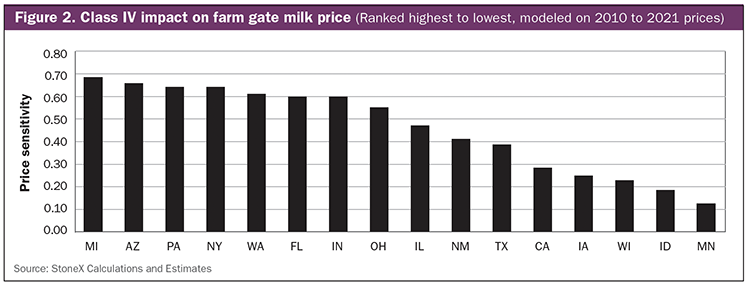

Farmers are paid a blended average price for their milk, and the blend changes from region-to-region, depending on local processing capacity. Some regions have a lot of cheese plants, which means the farm level milk price is primarily driven by Class III. Meanwhile, other regions have a lot of butter, nonfat dry milk, or yogurt capacity, which means their milk price will be driven more by Class IV milk.

When the pandemic hit and the government elevated dairy purchases in 2020, those purchases were weighted toward cheese. That, in turn, drove cheese prices to record highs and spiked the Class III milk price. That was good news for farmers in regions with a lot of cheese processing capacity, but farmers in other regions saw less of a benefit from those purchases. With Class IV moving above Class III in 2022, those Class IV farmers look like they will gain back a little bit of what they missed out on in 2020.

Ranked by Class IV

We took a look at the All-Milk price for the top 16 milk producing states and ran some statistical models to see how sensitive the All-Milk price was to Class III and Class IV in each state. Figure 2 ranks those states based on the most sensitive to Class IV prices to least sensitive. After this analysis, I was surprised to see Michigan was the most sensitive to Class IV prices. The models were run on historical data from 2010 to 2021, and with the new cheese plant in St. Johns, pricing in the state should become a little more sensitive to Class III.

I wasn’t surprised to see the rankings for the other states. Minnesota, Idaho, Wisconsin, and Iowa are largely driven by Class III, while Arizona, Pennsylvania, New York, Washington, and Florida are driven by Class IV.

No U.S. dairy product is driven more by the world market than nonfat dry milk (NFDM). A graph of U.S. prices versus our main export competitors shows a very strong long-run correlation. Again, the U.S. NFDM fundamentals have tightened up with stocks held by manufacturers down 21% from the previous year in November. But without the strength that we’ve seen in global powder prices, the upside for U.S. NFDM prices would be capped.

If the futures are right, then everyone should see good milk checks this year. With the Class IV milk price looking stronger than Class III, dairy farmers in states with more Class IV and Class II sales are going to see an extra boost compared to the big cheese states driven by Class III prices. That is good news for some producers who missed out on the upside in 2020.