In just two years, Dairy Farmers of America (DFA) transformed itself from selling over one-half of its members’ milk to third-party processors to processing two-thirds of its own milk into dairy products. That swift transformation all came about because of the demise of Dean Foods.

“Bankruptcy for Dean was not part of our business plan,” shared Rick Smith, DFA’s president and CEO, with those attending the cooperative’s 24th annual meeting in Kansas City, Mo. “We had a lot of work to do when we acquired Dean Foods. Dean Foods went bankrupt for a reason. It was burning through $1 million of capital per day, every day, before we took ownership of it,” Smith went on to say of the acquisition of the nation’s largest fluid milk processor that came at a cost of $433 million. The purchase included 44 plants, and ownership officially transferred on May 1, 2020.

“We eventually had to close two plants due to lack of profitability,” Smith explained at the first in-person gathering of the nation’s largest dairy cooperative since 2019. During the COVID-19 pandemic, the cooperative met virtually for two years in a row.

Back in 2019, prior to the Dean Foods acquisition, just 15% of DFA’s milk had been going through its processing plants, with another 30% going to plants that were either DFA affiliates or alliances. That left 54% of the milk searching for a home via third-party processing.

Fast forward two years and that narrative took a 180-degree turn. The transformation falls nearly perfectly into three equally sized pieces in a pie chart, with 33% of its member milk headed to DFA-owned processing plants, 34% to DFA affiliates and alliances, and 34% to third parties. (Editor’s note: Percentages do not add up to 100% due to rounding.)

Bringing back brands

After adding Dean Foods into the portfolio, the nation’s largest dairy cooperative, marketing 29% of U.S. milk, took an introspective look at its brands. “We made a conscious decision to bring back our regional brands,” said Alan Bernon, who serves as president and CEO of dairy brands for DFA. “We wanted consumers to reconnect with the cherished brands they grew up with and recognize.”

As for delivering products with those brand names to the marketplace, that hasn’t been easy as of late. “I’ve been in the industry for 46 years,” said Bernon. “I haven’t seen the kind of disruption as I’ve seen in the past two years. We are looking for 900 additional employees to join our ranks.”

Those 900 employees are needed to fill gaps in processing plants. That number doubles to 1,500 when one looks co-op wide for staffing needs. “Disrupted supply chains and COVID-19 have led to 1,500 open positions at DFA,” Smith further explained. “That’s 10% of our workforce.

“Supply chains are so disrupted these days,” said Smith. “The supply chain, in our case, starts with the milk hauler. That’s not getting any easier. We have over 3,000 truckloads a day moving around the United States serving over 400 customer locations.”

“We are in a growth industry, and we are succeeding,” Smith shared at the annual meeting held from March 21 to 23. “Earlier in my career, we were always fixated on imports. We are not fixated on imports anymore,” said Smith.

“Almost 20 years ago, then CEO Tom Camerlo painted a picture, at this podium, of how DFA could become a dairy exporter. We have grown dairy exports tremendously since that time,” stated Smith. “U.S. milk grows every year. We grow on average 1.5% each year. Half of that growth is used domestically. For the other half, we had to learn how to grow in the global market.”

Exports from 14 ports

Overall, DFA exported over 4,700 containers of dairy products from 14 U.S. ports in 2021. These products went to 60 countries and 200 global customers. The top ports for embarkation and container counts included: Oakland, Calif., 2,006; Los Angeles, Calif., 1,474; Long Beach, Calif., 1,152; New York, N.Y., 902; Norfolk, Va., 797; and Philadelphia, Pa., 372.

“The U.S. saw the largest growth among dairy exporters,” Jim Mulhern, president and CEO of the National Milk Producers Federation (NMPF), further explained in comments on the final day of the meeting. “The U.S. accounted for half of the world’s growth in dairy exports last year.”

“Cooperatives Working Together (CWT), which assists with dairy exports, showed a 26% increase in activity,” he said of the export assistance program.

“Despite record exports in 2021, supply chain snafus cost U.S. dairy an estimated $1.5 billion,” said Mulhern. “There is not a silver bullet to fix the situation, but a multi-prong approach will yield progress.”

Part of the problems involve U.S. ports, and the problems disproportionately exist on America’s West Coast.

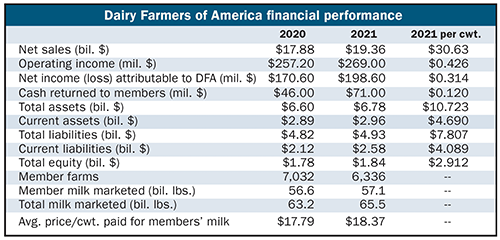

When looking at DFA’s financial performance, the co-op posted a record $19.3 billion in sales as shown in the table. “Our sales this year will exceed $20 billion,” predicted Smith, who will retire at year’s end.

“Last year, we had a strong year,” Smith said of net income. “Let’s call it $200 million of income,” he said using round numbers. “Our budget is saying we are not going to do as well this year. Again, we put the budget together in October,” he said, noting that was before higher waves of inflation and the Ukraine crisis came upon the scene. “So, the high watermark from pure operations will be 2021 for a few years,” he predicted.