Despite historic butterfat production from the nation’s dairy herd, full-fat dairy products continue to have red-hot demand as spot butter prices hover near $3 per pound on the CME. Consider this, the U.S. butterfat production totaled 7.3 billion pounds in 2011 and that number jumped to 9.1 billion pounds last year, as reported in the June 2022 article, “What’s driving record milk components?” Even with that growth, consumers have been demanding even more dairy fat.

Will this strong demand for butterfat and the resulting prices hold?

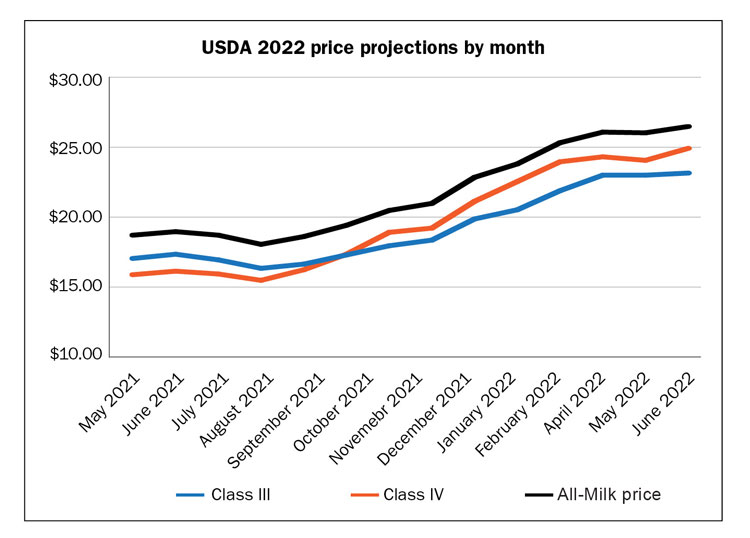

USDA economists believe they could hold for the time being. It’s one of the reasons that the Class IV price forecast moved from May’s $23.80 projection to $24.65 in June’s World Agricultural Supply and Demand Estimates. The upward projection on butter and powder prices moved the 2022 All-Milk forecast up 45 cents to $26.20 per hundredweight (cwt.) as shown in the figure.

Why is butter in short supply?

There are five main reasons butter remains in short supply, reports CoBank’s Tanner Ehmke.

- Increasing costs: “U.S. dairy farmers and butter processors are struggling to increase production, thanks to high costs of feed, energy, heifers, and labor.”

- Less milk and tight labor: “Some churns are slowing production due to tight U.S. milk supplies and short staffing at plants.”

- More demand for cream: “U.S. consumers have shifted their dairy product preferences, putting more demand pull on tight cream supplies.”

- Export demand: Resilient export demand is further tightening the U.S. butter balance sheet.”

- Same situation in the EU: “Record high butter prices in Europe, in particular, are the driver for the new export demand for U.S. butter.

Will the Class IV premium hold?

“Class IV milk prices are forecast to maintain a premium above Class III through 2023,” wrote Rabobank economists in their June 2022 newsletter. “Dairy commodity prices should soften from their peaks around Q2 2022 (second quarter of 2022) but will remain high compared to recent years. Whey will fare somewhat worse than other products based on weaker China demand.

“Rabobank forecasts average 2022 milk prices of $23.23 for Class III and $24.66 for Class IV.”

Rabobank’s Class IV price projection is within one penny of current USDA projections. On the other hand, Rabobank’s Class III cheese forecast is 33 cents higher than USDA.