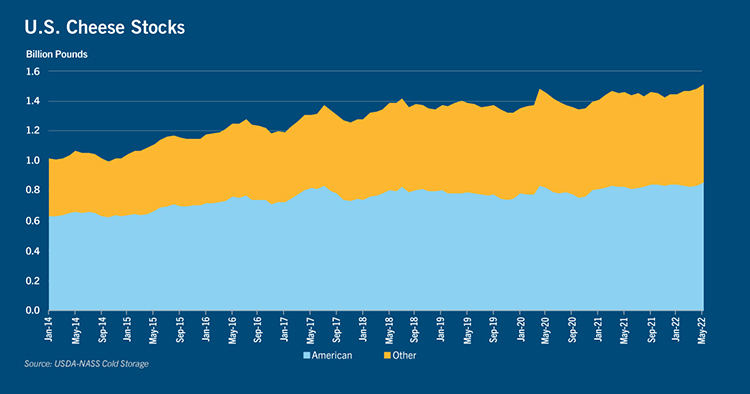

Despite tight supplies, milk continued to flow to cheese vats in the second quarter of 2022 with cheese manufacturers building inventories to record levels. Cheese production at the start of the quarter also continued its push to new record highs.

But in a concerning sign of consumers exhausted by high food prices, American cheese disappearance fell 10% year-over-year in April, while demand for other cheeses inched up only 0.6%. Retailers note consumers are also switching to lower priced and private label cheeses to save on cost.

The sharp slowdown in domestic cheese demand coupled with rising production pushed U.S. cheese inventories to new record highs, especially with American-style cheeses. Total cheese stocks were 1.5 billion pounds, surging 31 million pounds from the previous month. Conversely, U.S. butter inventories remain tight. High prices and strong demand for U.S. milkfat from both domestic and international sources pulled butter out of storage.

Although U.S. cheese and butter exports have posted an impressive pace, inflation-wary consumers are trimming food budgets. This has raised concerns that ample cheese inventories could last through the remainder of 2022 and depress prices.

The latest data on food prices from the Bureau of Labor Statistics reveals that U.S. consumers quickly pivoted to “value purchases” with products like hot dogs, chicken, and margarine leading the price rise. For dairy products consumed at home, prices in June rose 13.5% year-over-year, compared to 11.7% for meat, poultry, fish, and eggs, and 8.1% for fruits and vegetables. Processed cheese rose 13%, while Cheddar natural cheese climbed at a milder pace of 7.3%. All food at home rose 12.2%.

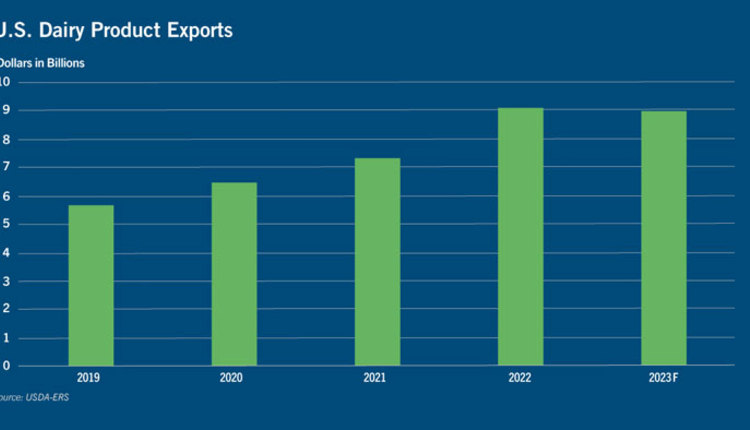

Strong exports are hoped to be the relief valve on rising U.S. cheese supplies for the remainder of 2022, counterbalancing losses in domestic demand. With strict COVID-19 lockdowns in China relaxing, a bounce back in demand is expected there.

Central to the cheese export story is Mexico, with the U.S. supplying 79% of Mexico’s total imports as of 2021. While Mexican imports of U.S. cheese continually mark record highs, concern is growing that lower-to-middle income consumers in Mexico may pare back cheese consumption in the face of rising food costs.