No matter what kind of insurance a dairy owner has, not needing to use it means nothing bad has happened, which is exactly what they hope for.

On the other hand, not using it means it was an overhead cost that generated no income, which no business can afford.

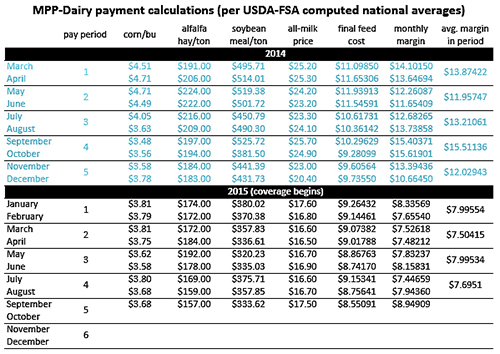

According to official feed cost and margin calculations done by USDA for the first nine months of 2015, the only Margin Protection Program for Dairy (MPP-Dairy) insurance payments made so far have been to the 269 producers nationwide who bought optional coverage at the maximum $8 per hundredweight level.

That coverage cost 47.5 cents per hundredweight for dairies producing less than 4 million pounds of milk per year (equal to a herd of 187 cows producing at the national average per head) versus $1.36 per hundredweight for dairies making over 4 million pounds per year.

But $8 coverage has not been a great deal even for those who bought it. Payments amounted to less than ½-cent per hundredweight in the January to February and May to June periods, about 30 cents per hundredweight in the July to August period, and not quite 49 cents per hundredweight in the March to April period.

Higher milk prices and lower feed costs in September make it very unlikely that any payments will be made for the September to October period.

No one who bought MPP-Dairy coverage below $8 has received anything so far, which means the 1,430 producers who bought $7.50 coverage are the biggest losers so far.

The biggest winners, at least in terms of simple cost versus return, are the 20,638 milk producers (45.5 percent of U.S. total) who saved the $100 MPP-Dairy sign-up fee for basic $4 coverage and are not participating at all.

The author has served large Western dairy readers for the past 38 years and manages Hoard's WEST, a publication written specifically for Western herds. He is a graduate of Cal Poly-San Luis Obispo, majored in journalism and is known as a Western dairying specialist.