The author is the director of dairy policy analysis at the University of Wisconsin.

It's hard to get producers out to meetings in the summer, but I've got a dozen meetings behind me and another dozen to go. And, we've had really good attendance - more than 100 at several of the meetings. They're coming out during this busy season to learn more about the new Margin Protection Program for Dairy, or MPP-Dairy.

You've probably read about the program several times over the past few months. It may sound complicated, and you may be tempted to ignore the decision. But I think you will find that, with just a little work on your part, it won't be hard to make an informed decision that will reduce price risk on your operation. The enrollment period this year is from September 2 through November 28 at your local Farm Service Agency office (FSA).

Tools to assist in your decision

We have developed a decision tool that takes a lot of the complexity out of your way. You need to enter the pounds of milk that is referred to as your "production history." For most farms, this is the highest annual production you achieved in 2011, 2012 or 2013. And you will want to look at the market information for the calendar year ahead. We have simplified this by collecting the futures market data every night and calculating an up-to-date forecast MPP-Dairy margin for you. And based on options prices, we can even calculate the likelihood that we will see the forecast margins over the year ahead.

When you have that information, you can consider your choices for coverage level and coverage percentage of your production history. We calculate what your premium costs would be at the different levels and what the expected payments would be in the year ahead. That helps you make the decision about what level to sign up for.

When evaluating your options, also think about this decision with regard to what level of protection you might need. For example, farms with a high degree of debt probably need a higher level of coverage. And you should consider your personal risk preferences. If you can't sleep at night because you are worrying about talking with your banker about your need for additional operating loans (even though you are credit worthy), then you also might want to consider a higher level of coverage.

Be a time traveler.

The decision tool lets you go back in time and imagine what kind of decision you would have made if the program had been in place in earlier years. The advantage of doing this is that you can see what the outcome would have been for the choices you made. It will also help to convince you that using futures market data to forecast the margins really can be a helpful aid in making choices for the enrollment year ahead.

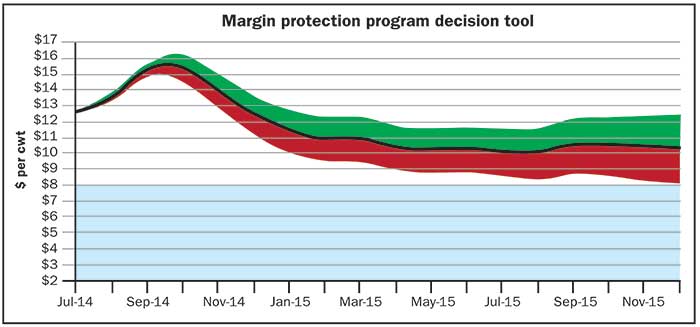

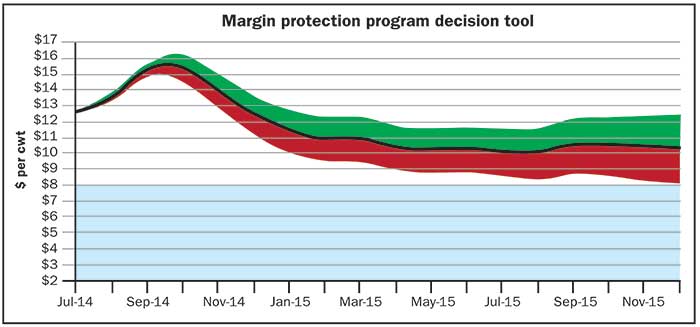

The graph shows you the expected margins in the black line and the green and red bands show you the 25 percent probability range of the prices being above or below that line. Of course, there is another 25 percent probability that the prices could be above the green band or below the red band, too. But it helps to know the level of confidence you can place in the forecasts. If you play with the historic values, you will get a feel for how well the futures markets do with prediction of future events.

If you look at the historic patterns with an eye toward your farm, you can also choose coverage levels and then reveal what the actual payments would have been. Add up your gains and losses over a few years time and see what the impact would have been on your farm.

You've got time

Currently, the futures markets do not predict there is much chance of payments in the last four months of 2014. Additionally, 2015 is also looking like a good year. Consider the level of protection you need or feel comfortable with and head on over to your FSA office. You still have until November 28 of this year to make a decision about 2014 and 2015 coverage. And if you miss this year's sign-up opportunity, you can still sign up in next year's enrollment period which will be July 1 through September 30, 2015, for coverage in the 2016 calendar year. This sign-up pattern will continue until the farm bill expires in 2018.

The MPP-Dairy program is a new tool in your risk management toolbox. It isn't as simple to use as MILC was, but it can provide much better protection. Do yourself the favor of learning more about the program at your FSA or extension offices, ask your cooperative about the program, or get online and use the decision tool. You owe it to yourself to learn more about this valuable new program.

The Margin Protection Program Decision Tool can be found at: http://DairyMarkets.org or at www.fsa.usda.gov/mpptool.

Click here to return to the Dairy Policy E-Sources

140925_591

It's hard to get producers out to meetings in the summer, but I've got a dozen meetings behind me and another dozen to go. And, we've had really good attendance - more than 100 at several of the meetings. They're coming out during this busy season to learn more about the new Margin Protection Program for Dairy, or MPP-Dairy.

You've probably read about the program several times over the past few months. It may sound complicated, and you may be tempted to ignore the decision. But I think you will find that, with just a little work on your part, it won't be hard to make an informed decision that will reduce price risk on your operation. The enrollment period this year is from September 2 through November 28 at your local Farm Service Agency office (FSA).

Tools to assist in your decision

We have developed a decision tool that takes a lot of the complexity out of your way. You need to enter the pounds of milk that is referred to as your "production history." For most farms, this is the highest annual production you achieved in 2011, 2012 or 2013. And you will want to look at the market information for the calendar year ahead. We have simplified this by collecting the futures market data every night and calculating an up-to-date forecast MPP-Dairy margin for you. And based on options prices, we can even calculate the likelihood that we will see the forecast margins over the year ahead.

When you have that information, you can consider your choices for coverage level and coverage percentage of your production history. We calculate what your premium costs would be at the different levels and what the expected payments would be in the year ahead. That helps you make the decision about what level to sign up for.

When evaluating your options, also think about this decision with regard to what level of protection you might need. For example, farms with a high degree of debt probably need a higher level of coverage. And you should consider your personal risk preferences. If you can't sleep at night because you are worrying about talking with your banker about your need for additional operating loans (even though you are credit worthy), then you also might want to consider a higher level of coverage.

Be a time traveler.

The decision tool lets you go back in time and imagine what kind of decision you would have made if the program had been in place in earlier years. The advantage of doing this is that you can see what the outcome would have been for the choices you made. It will also help to convince you that using futures market data to forecast the margins really can be a helpful aid in making choices for the enrollment year ahead.

The graph shows you the expected margins in the black line and the green and red bands show you the 25 percent probability range of the prices being above or below that line. Of course, there is another 25 percent probability that the prices could be above the green band or below the red band, too. But it helps to know the level of confidence you can place in the forecasts. If you play with the historic values, you will get a feel for how well the futures markets do with prediction of future events.

If you look at the historic patterns with an eye toward your farm, you can also choose coverage levels and then reveal what the actual payments would have been. Add up your gains and losses over a few years time and see what the impact would have been on your farm.

You've got time

Currently, the futures markets do not predict there is much chance of payments in the last four months of 2014. Additionally, 2015 is also looking like a good year. Consider the level of protection you need or feel comfortable with and head on over to your FSA office. You still have until November 28 of this year to make a decision about 2014 and 2015 coverage. And if you miss this year's sign-up opportunity, you can still sign up in next year's enrollment period which will be July 1 through September 30, 2015, for coverage in the 2016 calendar year. This sign-up pattern will continue until the farm bill expires in 2018.

The MPP-Dairy program is a new tool in your risk management toolbox. It isn't as simple to use as MILC was, but it can provide much better protection. Do yourself the favor of learning more about the program at your FSA or extension offices, ask your cooperative about the program, or get online and use the decision tool. You owe it to yourself to learn more about this valuable new program.

The Margin Protection Program Decision Tool can be found at: http://DairyMarkets.org or at www.fsa.usda.gov/mpptool.

140925_591