Forecasting still boils down to supply and demand. My most useful forecast tool is a supply and utilization table where I organize my information and build up things like milk production. If I think that there is a story about cow numbers or production per cow, then that will alter my production forecast.

Of course, I also have to look at dairy product stocks — the ballast tank for the dairy industry — and see if there is a story there. What about our economy and changing consumer preferences for out-of-home dining or fluid milk consumption?

Until about a dozen years ago, I didn’t have to think about exports. Our dairy economy was large and mostly internal, with very little international trade to worry about. It is a different story today and export customers are a significant piece of U.S. dairy demand.

It is hard enough to keep track of changing demand patterns for dairy products in countries like Mexico, China, and others. The size of the spreadsheets that I use to organize data has ballooned since I now keep an eye on competitors for world markets and digest what is happening in their dairy industries, too.

I thought that I was getting on top of all of that, and I believed that my data set was large enough to accommodate domestic and foreign ripples in supply and demand.

EVERYTHING CHANGED

Until a little more than a month ago, I was feeling cautiously optimistic about a milk price recovery in 2018. Sure, we still had large stocks of powder in Europe to work down and our own stocks of cheese and powder were on the heavy side, but there were signs of purchases coming out of several countries and our domestic demand looked to be fairly strong. And, because of hot weather, gains in milk production in the European Union (EU) were even slowing down a bit. The markets looked ready to improve milk prices, not like 2014, but foreign and domestic product prices were strengthening and my colleagues in Europe and Oceania were optimistic.

Our own futures markets confirmed the optimism. They are a wonderful sponge soaking up market information and wringing out prices. When the U.S. announced tariffs on aluminum and steel from several countries in June, Mexico and China — two of our largest dairy product customers — retaliated with tariffs on agricultural products including dairy.

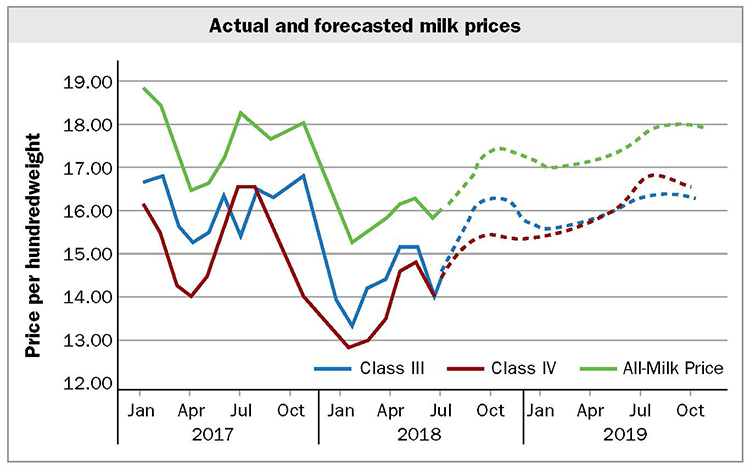

Almost immediately, futures markets reacted to the news by reversing the earlier gains and dropping somewhere between $1.50 and $2 per hundredweight (cwt.) in most months. This was devastating news to dairy producers who were well into the fourth year of relatively low milk prices.

Markets don’t like uncertainty, and the initial reaction to trade impacts was probably an overreaction to the likely outcomes. The USDA’s estimate of the impact of tariffs on dairy trade seemed to confirm something less than that number.

We still don’t know all of the details of the trade relief package announced by Secretary of Agriculture Sonny Purdue, but insiders are saying that dairy accounts for about $1.6 billion of the $12 billion in aid. That $1.6 billion on a little more than half a year’s production is about a $1 per cwt. impact in 2018.

A MORE ROBUST MODEL

A colleague and I have been working for a couple of years on a fairly comprehensive dairy trade model. When we impose the tariffs from Mexico and China, we certainly do see an impact, but over time, it’s not as large as we are seeing in the short run.

First of all, at current prices we are still likely to sell whey to China even with tariffs. This happens partly because there isn’t another supplier with enough capacity to fill all of China’s demands and partly because our whey prices are somewhat discounted compared to the European Union’s anyway. We are still likely to be in the competitive range even with the imposed tariffs.

Mexican tariffs are a bit different. We aren’t always in a competitive price range with cheese, and tariffs could make those sales even more difficult. However, we have developed strong customer associations over many years, and neither the buyer nor the seller want to give up those relationships over a short-term problem. And, given our proximity to Mexico, we can still service accounts more easily than our competitors can.

Yes, the tariffs are a problem, and if they stay in place for a long period of time, they will create lasting damage to our export markets. We will find new overseas customers, and we hope that NAFTA negotiations might be completed quickly so that we can get back to business with our neighbors.

I am forecasting milk price improvements through the rest of 2018 and through most of 2019. Not a meteoric climb, but a steady improvement to a 2019 average that should feel a lot like 2017.