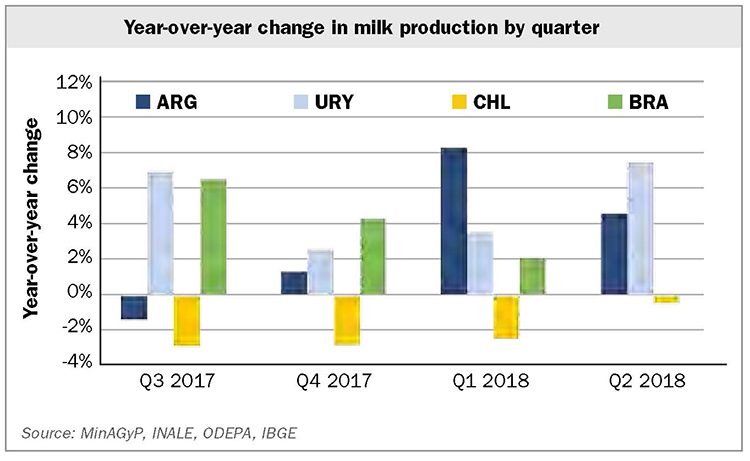

Even while facing a number of challenges, year-over-year output continues to grow in most countries. However, ominous clouds are gathering on the horizon, casting a shadow over the milk production forecast and indicating that more difficult times lie ahead.

THE ROAD TO RECOVERY

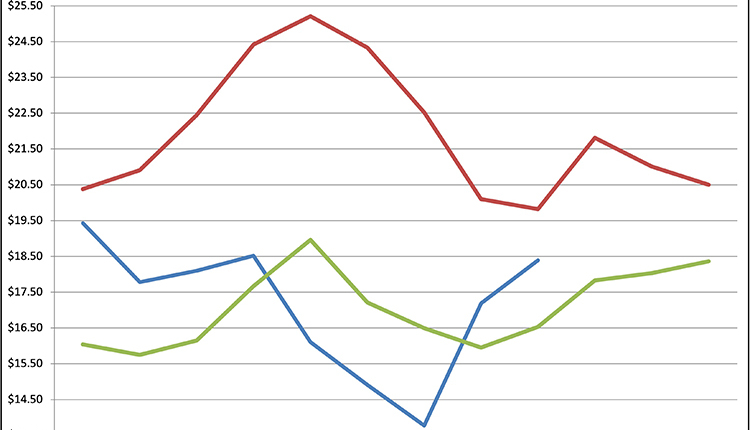

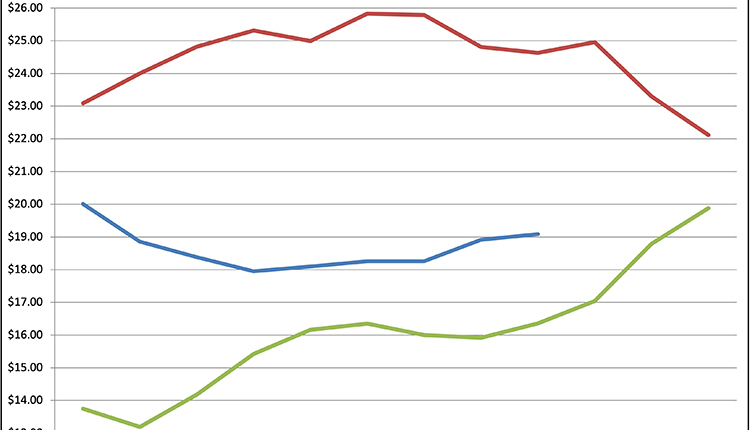

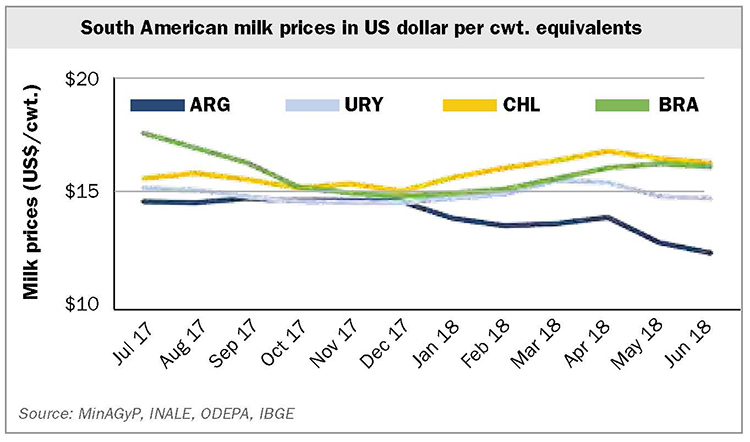

South America’s production sector has staged an important recovery over the last few months. Higher milk prices, coupled with only moderate growth in operating costs, have created margin conditions that allowed dairy farmers to invest in their businesses and expand output. At the same time, the weather has been generally cooperative, creating conditions for production superior to 2016 and 2017.

As a result of the improved circumstances, cumulative milk production so far in 2018 is up in most countries. Argentina and Uruguay, the continent’s two biggest dairy product exporters, have posted the most impressive growth.

Argentina’s output during the first half of the year is up over last year by 7.3 percent.

Uruguay is not far behind, with year-to-date growth of 6.3 percent.

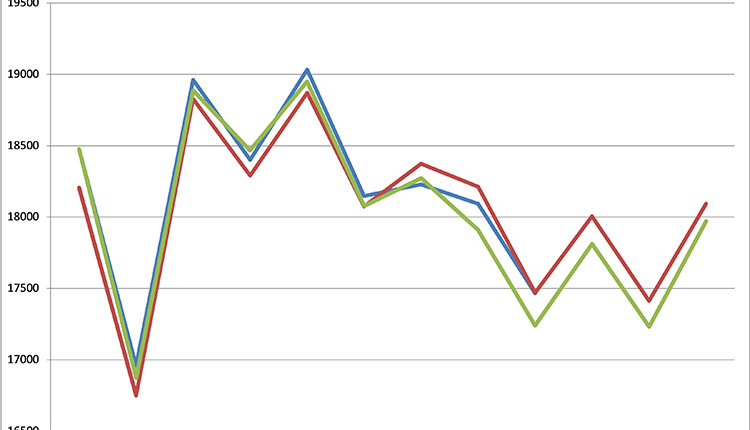

In Brazil, milk production had been leading prior to this year by at least a few percent until a trucker strike at the end of May derailed growth. Official statistics detailing the severity of the impact will be available soon.

RISKY BUSINESS

Although the industry has been performing well so far this year, several serious risks are developing that threaten milk production through the balance of the year. The first of these is climatic risk. The National Oceanic and Atmospheric Administration is forecasting a transition from a neutral to an El Niño weather cycle over the coming months. The El Niño phenomenon typically brings wet weather to the dairy regions of Argentina, Uruguay, and southern Brazil.

At the same time, hot and dry weather will probably affect the northern part of the continent. These impacts are likely to undermine cow comfort, complicate logistics, and discourage crop growth.

In addition to weather, broad economic factors are also likely to wreak havoc on South America’s dairy sector. Like other emerging economies around the world, countries in Latin America are feeling the impact of reduced enthusiasm from foreign investors . . . for both agriculture and the overall economy in general. In turn, local currencies across the continent have depreciated.

The weaker currencies have created an environment of uncertainty for consumers and are feeding inflationary pressures. For dairy farmers, any inputs that are bought and sold in dollars, such as grains, have also become relatively more expensive.

Finally, dairymen are also likely to face greater margin pressure through the end of the year. Domestic consumers, spooked by their own precarious economic situations, are not likely to absorb additional dairy product price increases. Because of this, the domestic market will have little space to offer dairymen higher milk prices.

On the other side of the equation, as grain stocks run low and dollar denominated inputs become relatively more expensive, operating costs will rise. This combination will create significant pressure on dairy farmer profits, discouraging investments and expansion.

CHALLENGERS AHEAD

It is clear that although there has been much to celebrate in South America’s dairy sector over the last few months, the party may be coming to an end. The risks facing the industry must be taken seriously, and mitigation strategies should be implemented where possible to help ease the sector through the coming months. Despite the challenges, South America’s dairy farmers are nothing if not resilient, and they will undoubtedly take these difficult months in stride.