In your December 2018 issue

DAIRY PROVISIONS HAVE BEEN STRENGTHENED in the new farm bill. Significant adjustments were made in both level of margin support and premium costs for the dairy safety net. For more on the new Dairy Margin Coverage program, read pages 9 and 16 in this issue.

USDA ANNOUNCED ITS SECOND and final round of trade mitigation payments aimed at assisting farmers who suffered from trade retaliation. Once again, soybeans received the lion’s share — 76 percent — of the $9.6 million made available via the Market Facilitation Program (MFP).

OF THE NINE AFFECTED CROPS, only almonds and wheat received less compensation. Dairy farmers can sign up to receive 12 cents per hundredweight for their farm’s respective milk production. Overall, U.S. dairy farmers received $254,800 in the second round of payments.

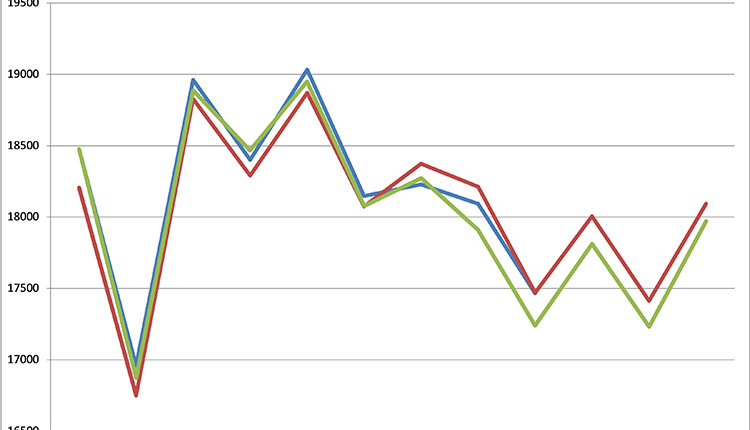

A RATHER PESSIMISTIC PRICE FORECAST has continued for the start of the new year with January to March 2019 Class III futures trading near a $14.60 per hundredweight average. May to November 2019 contracts traded higher at a $16.20 blend with a September high of $16.65.

USDA FORECASTS MATCH the futures market as its economists pegged a $16.80 All-Milk price with a potential range from $16.40 to $17.20 for 2019. This was down from the $16.70 to $17.60 forecast one month earlier.

BACK-TO-BACK GAINS WERE POSTED for the first time since May at New Zealand’s Global Dairy Trade. In late-December biweekly trading, products sold 1.7 percent higher, after 2.2 percent gains two weeks earlier.

THE DAIRY HERD SHOULD continue to shrink as USDA suggested that there could be 9.365 million cows in the upcoming year. During 2018, cow numbers climbed to over 9.4 million — the highest level in two decades.

CULLING REMAINED HIGH at the national level as 133,000 more dairy cows were sent to packing plants through November compared to the first 11 months of 2017. Overall, 2,833,500 head have been slaughtered.

WHOLE MILK CONTINUED to be a bright spot as the subcategory of fluid milk sales rose 1.5 percent in the first 10 months of 2018. Reduced fat (2 percent), low fat (1 percent), and skim milk sales were all down.

AMERICAN CHEESE STOCKS, led by Cheddar, have climbed to a record level of 1.4 billion pounds. The glut of cheese can be attributed to slowed sales to Mexico (down 10 percent) and China (down 63 percent). Both countries instituted retaliatory tariffs on U.S. cheese.

DAIRY FARMERS OF AMERICA (DFA) PURCHASED a fluid milk processing facility located in St. Paul, Minn., from Quebec-based Agropur. The facility expands DFA’s ability to manufacture extended shelf life and aseptic dairy products for grocery chains and organic milk brands

In your next issue!

MORE CHEESE, PLEASE.

Cheese is becoming far more important to the U.S. as an export product, due in part to growing global demand and higher returns when compared to other dairy products.

ARE COWS SEASONAL WORKERS?

Cows have an underlying biological clock that is likely impacting milk, milkfat, and protein production.

LARGE OR SMALL, THESE HERDS TURN OUT QUALITY MILK.

With herd sizes from 50 to 1,600 cows, these National Dairy Quality Award winners prove that every herd can produce quality milk.