Financial strategy for dairy farms during COVID-19 has looked a little bit like a roller coaster. While milk prices plummeted and then started to rebound, many farmers revisited their budgets. To gain insight on where farms are looking to find some financial stability, Hoard’s Dairyman DairyLivestream posed the question to audience members, “What actions are you taking during this economic downturn?”

The answers were revealing.

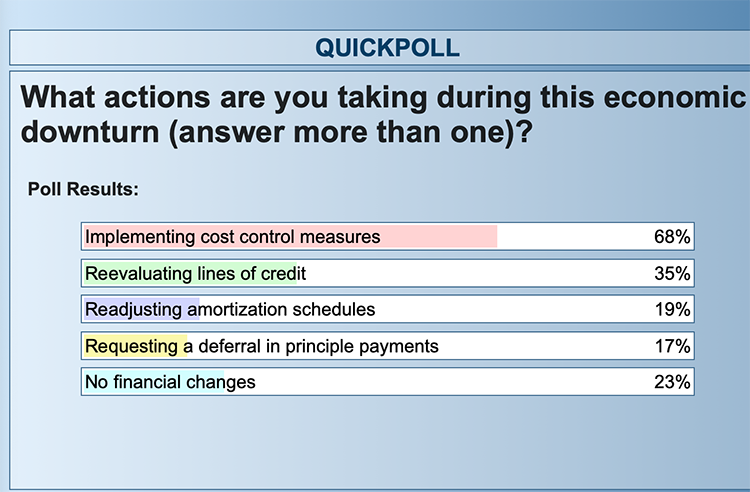

Of the webcast’s May 20, 2020, participants:

- 68% have looked to implement cost control measures

- 35% have looked to re-evaluate lines of credit

- 23% have chosen to make no financial changes as of this time

- 19% have readjusted amortization schedules

- 17% have requested a deferral in principle payments

DairyLivestream guest speakers Sam Miller from BMO Harris Bank and Roger Murray from Farm Credit East shared some of their insights on how their producers have re-evaluated their budgets in light of COVID-19 market disruption in order to better weather the storm.

“In no particular order, we started looking at our portfolio, and we looked first at what was the cost of production on a client-by-client basis,” Miller, who serves as his bank’s managing director of agricultural banking, said. “What price risk management plans did our clients have in place — Dairy Margin Coverage, Dairy Revenue Protection, contracts, futures, and options positions?

“We looked at where their milk was being shipped and what that particular processor was doing,” he continued. “Were there any quotas they were putting into place, were there cutbacks, what kind of dumping milk was going on? Then we looked at their working capital position. What cash, working capital, and borrowing capacity did they have to withstand whatever difficulty occurred in milk pricing?”

Best financial strategies

With all that knowledge considered, Miller shared that his bank had helped several clients take advantage of the Small Business Administration’s (SBA) Paycheck Protection Program. They’ve also worked with clients to consider cost control measures, debt servicing measures, increasing lines of credit, readjusting amortization of debt, and principle deferrals.

“Our keys that we’ve been talking to customers about for success are utilizing and leaning on trusted advisers whether that’s your veterinarian, nutritionist, loan officer, or others,” Murray said. “Work on developing Plan A, Plan B, and even Plan C. Utilize all those tools available whether it’s USDA’s Coronavirus Food Assistance Program, Small Business Association loans, and so forth.”

Certainly, farm books have changed in the past several months, but open communication and planning can help farms to bridge the income gap. Also discussed during “The dairy farm finance pivot” was the importance of communication during COVID-19 and details of what farmers can expect from the Coronavirus Food Assistance Program.

The Wednesday, May 20 episode of DairyLivestream was sponsored by Diamond V and can be found here.

An ongoing series of events

The May 27 DairyLivestream will feature “Candid comments from the nation’s capital” with special guests Michael Dykes, CEO of the International Dairy Foods Association, and Jim Mulhern, CEO of the National Milk Producers Federation.

As always, the panel of experts will discuss over 30 minutes of audience questions. If you haven’t joined a DairyLivestream broadcast yet, register here. Registering once registers you for all future broadcasts.