Currently, Class III milk prices have seemingly recovered from the initial COVID-19 supply chain disruptions to offer relatively high futures prices. There is an underlying concern that demand might weaken depending on the pandemic infection pattern and related income effects, but there is also a desire to not miss out on the potential for higher milk prices. At the time of this writing, Class III milk prices for the next couple of months exceed $20 per hundredweight (cwt.), then trail off a bit to finish 2020.

Four main components

As the recent price changes make clear, a high Class III price does not necessarily mean a high mailbox milk price. It is useful to think about the mailbox milk price having four components in most of the U.S.:

1. Class III (base) milk price.

2. Federal order pool value other than the Class III base (the producer price differential, or PPD).

3. Cooperative and regional market aspects.

4. Farm specific aspects (component tests, quality, and hauling).

For June 2020, the announced Class III price of $21.04 per cwt. was significantly higher than most producer paychecks for the month because of a negative PPD and cooperative or market adjustments related to marketing and hauling milk.

The negative PPD was driven by:

• The quick change in milk prices and a lagged use of Class I price

• The disparity between Class III and Class IV prices given the use of an average price for Class I

• Depooling Class III milk in large quantities

Three dimensions

A wise dairy economist once noted that farm milk price can be viewed through three dimensions: predictability, variability, and adequacy.

Predictability, refers to the degree of certainty in the price. Futures contracts and forecasted milk prices can be viewed as probabilistic. That is, participants bring supply and demand information to the market, and prices on any given day are based on the information at that time.

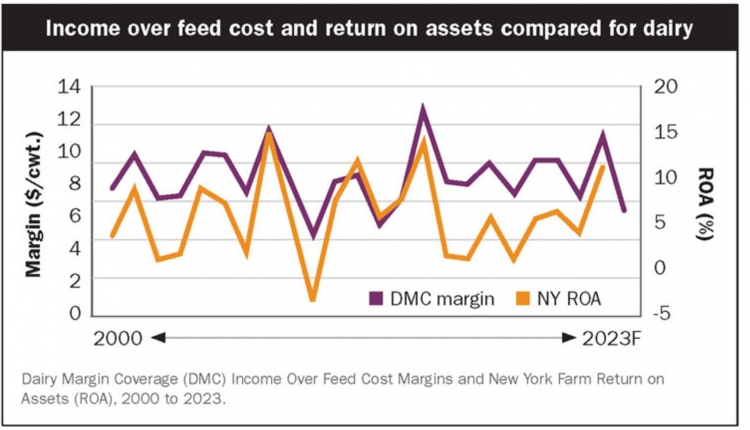

Variation refers to the amount of up and down in a time series of prices. Price variability is often considered undesirable. However, some degree of variation is expected given the seasonality of dairy product supply and demand. Also, consider the lack of milk price variation in 2002 to 2003 and from 2015 through the first half of 2019. Both periods had relatively stable milk prices but were not adequate for farms to generate profit.

Thus, the third dimension is adequacy. Adequacy refers to whether a given milk price is sufficient to generate a needed return.

Judging the milk price opportunities offered by futures, options or forward contracts can be done relative to several factors including historical prices, market fundamentals, expert opinion, and cost of production.

Historic milk price patterns give a degree of guidance. In general, prices are lowest in late winter or early spring and highest in the fall months leading into the holiday season. Since federal order reform about 20 years ago, the average Class III price through June 2020 was $15.11 per cwt. The highest price (ignoring inflation) was $24.60 per cwt. (September 2014) and the lowest price was $8.57 per cwt. recorded in November 2000.

The average month-to-month price change was less than a nickel but there were large changes with the largest single-month decline being -$4.50 per cwt. from December 2008 to January 2009 (think Great Recession) and the largest single-month gain from May to June 2020 at +$8.90 per cwt. (pandemic recovery).

An unstable prediction

Historic price patterns can be a poor guide in extraordinary times. Market fundamentals refer to supply and demand factors. At the current time, demand — both domestic and international — is the overwhelming concern given the changing consumption pattern and household income effects of the pandemic. Supply response will be of great interest as the high milk prices work their way into farm milk checks.

Futures markets bring together the information and views of market participants that are both buying and selling. While the dairy futures are not as liquid as those of corn, for example, they are unbiased and efficient predictors of prices. However, they are not particularly good at anticipating large price changes due to either supply or demand shocks. The inelastic nature of both milk supply and demand means that small changes in quantity of either results in relatively large price changes.

Also, keep in mind that the degree of unpredictability climbs with the time to expiration as there are more opportunities for supply or demand shocks. Thus, one way to think about futures prices is as a price you could have (or pay) rather than a forecast particularly for far out months.

Cover the costs

A preferred standard to assess milk prices is relative to farm cost of production. How much is required to cover cash costs? What milk price is required to cover variable costs? What is required to cover all costs of production and generate a true profit?

Income and cash flow statements can assist in understanding these values. Covering variable costs such as feed and labor is necessary.

In the short run, there may be periods where the only option is to minimize loss rather than maximize return. In the longer run, all costs, including a fair return to management and capital, are required. Knowing these costs can assist in assessing pricing opportunities.

The primary difficulty in assessing milk prices today is “basis” uncertainty. That includes unpredictable PPD, market, and farm price effects. The current negative PPD means that a $20-plus per cwt. Class III price will not translate to a mailbox milk check that high for most farms. Market adjustment costs related to distressed milk sales and dumped milk in some regions further adds to negative basis.

A negative PPD has historically meant that higher prices were imminent as the lagged prices work their way into Class I minimums. The use of the “average” of Class III and IV rather than the “higher of” for pricing Class I is a recent twist. Given the approximately $10 per cwt. difference between Class III and IV, this PPD situation is unprecedented and more difficult to judge.

Similarly, there has been significant market adjustment in recent years as processing capacity and milk production seek a balance. These market adjustment costs — distressed and/or dumped milk — have played havoc with milk basis for many producers. Milk dumping due to COVID-19 appears to have tailed off, however.

There is no silver bullet here. However, knowledge is useful in establishing a market position. Those considerations include the cost of production and cash flow needs, historic basis, and cooperative or regional market adjustment situation and outlook.