Dairy markets have a new driver at the wheel: demand. Before 2020, dairy markets hinged mainly on the dynamics of milk supply. Milk prices hinged primarily on weather events, feed costs, and other factors that altered farm-level decisions. Demand was a relatively stable part of the equation, and demand shifts tended to happen gradually over time.

Rabo AgriFinance

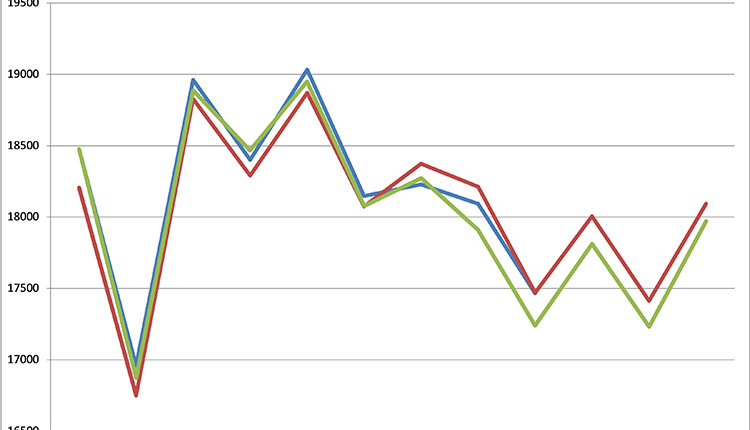

The economy experienced a sharp blow when COVID-19 first took hold. U.S. gross domestic product (GDP) fell 31.4% in the second quarter (Q2), followed by a quick rebound up 33.4% in the third quarter (Q3). Rabobank forecasts GDP growth of 4.4% year-over-year (YOY) in 2021.

Compared to other recessions, the downturn in economic activity was much more dramatic and also more sudden. But in this case, the slowdown in activity was due to situational or mandated closures and stay-at-home orders rather than an organic slowdown in activity due to financial pressure. This has meant that with some fiscal relief, activity was able to pick back up quickly.

Fueled by fiscal relief, incomes during the recession actually grew. Consumers had income but nowhere to go with it. They stopped traveling, stopped going to events and stopped going to sit-down restaurants. The service sector took a significant hit. To the dairy sector, that meant a reduction in sales to food service.

Consumers instead took their buying power to other goods and groceries was among them.

Retail sales volumes of natural cheese remain up by more than 10% YOY for the four weeks ending March 7, and butter remains up as well, by just below 10% YOY. We expect to retreat toward more normal levels over time, but some degree of elevated retail sales should remain for the medium to long term.

Still, those elevated retail sales are not nearly enough to offset the demand lost at food service. We consume much more dairy when we eat away from home than when we prepare our own food at home.

The ongoing return to food service will be critical to watch. Also to watch is “How much consumers pick up the slack if government food box purchases slow in 2021.” A force working against consumer behavior could be inflation-induced sticker shock.

Fiscal stimulus tends to raise the risk of inflation, and food prices are part of that inflation. Higher commodity prices . . . including those record high cheese prices last year . . . represent higher input costs for food companies that have to be absorbed along the value chain to the extent possible, and ultimately by consumers. The same is true of higher feed costs as an input to milk production.

In February 2021, food prices rose by 3.6% YOY based on the Consumer Price Index. Dairy prices specifically were up 2.7% YOY. Dairy prices at retail were elevated through much of 2020 when consumers didn’t have many options and there was little promotional activity. Now that we’re returning to a more competitive environment, promotional activity should return as consumers face more choices about where to spend their food dollars.

Broader inflationary pressure should weaken due to the fact that wage growth will struggle to keep up. Wage growth was slow before COVID-19, when unemployment rates were low, and it’s unlikely to get better in a labor market with a lot of available workers. Even though jobs rebounded dramatically after the initial lockdowns, there will still be some 4 million Americans that remain out of work.

The majority of the U.S. milk price is a function of domestic demand, but we still rely heavily on our ability to export. And there is some heightened volatility on that front. Expect currency fluctuations, container disruptions, and global disparities in vaccine distribution to add a layer of uncertainty to the part of our milk price that is susceptible to global commodity markets.

Taken together, the economic forces facing the domestic consumer should be positive for demand. Meanwhile, on the supply side, we’re looking at milk production growing at a slower rate than we saw in the second half of 2021 as higher feed costs pressure margins. Slower milk production growth, when paired with strengthening consumer demand, should support milk prices moving through this year.

We expect less volatility than the industry experienced in 2020, but there will still be some uncertainty in global markets. RaboResearch forecasts Class III milk prices of $16.08 per hundredweight (cwt.) in the first quarter (Q1) of 2021, climbing to $17.57 in Q2 and remaining supported at an average of $17.73 for the second half of the year. Class IV prices should begin the year lower, at $13.64 per cwt. in Q1, and climb to $16.12 by Q4.