In your November 2021 issues . . .

MONTHLY CLASS IV FUTURES for November 2021 through October 2022 traded higher than similar Class III contracts. The strong forecast was directly linked to trading activity in which nonfat dry milk climbed to $1.56-1/2 per pound in early November — the highest price in seven years.

BUTTER ALSO BUOYED MILK CHECK PROSPECTS by gaining 23 cents per pound throughout late October and early November to reach $1.98 per pound, the highest price since June 2020. Both domestic and international purchases were strong. On the world stage, U.S. butter was 30 and 50 cents per pound cheaper than the EU and Oceania, respectively.

STRONG HOLIDAY ORDERS have been coming in early as food service and retail channels have been making purchases now given ongoing supply chain issues. This suggests buying could slow sooner, too.

ON THE CME, CLASS IV FUTURES yielded an $18.85 average for November 2021 through October 2022 contracts, with a $19.13 high in November. Class III netted an $18.30 mean for the same months.

FONTERRA RAISED ITS PRICE FORECAST 5% amid stronger markets. The New Zealand co-op’s 2022 projection would yield an $18.52 Class III price ($20.25 when converted to U.S. market-levels components). The range is from $17.42 to $19.62 for Class III equivalent. At market test, the range would be $19 to $21.45, calculated UW’s Mark Stephenson.

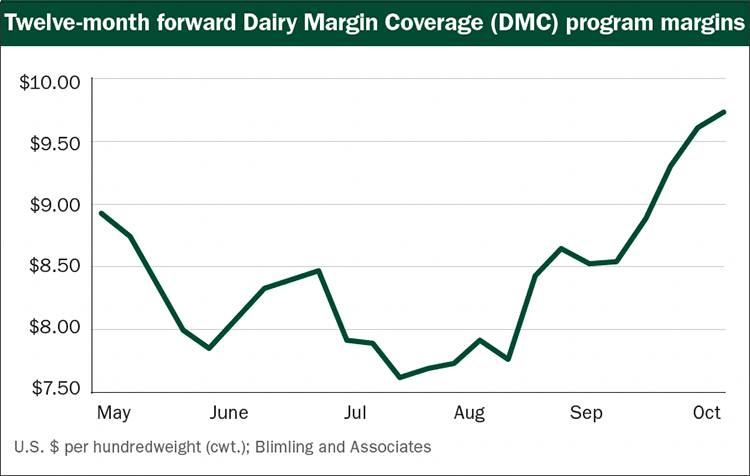

SEPTEMBER’S INDEMNITY WAS $2.57 per cwt. for the Dairy Margin Coverage program for farmers who insured milk at the $9.50 level. Price components included $18.40 milk, $5.45 per bushel corn, $226.50 per ton alfalfa hay, and $353.55 per ton soybean meal. Based on new crop forecasts and milk futures, the October payout should be lower.

MOST WORK SITE RAIDS WILL CEASE as the result of a memo issued by Homeland Security Secretary Alejandro Mayorkas. Instead, the agency will concentrate resources on the most unscrupulous employers.

U.S. AGRICULTURE WOULD HAVE MORE POWER to review foreign purchases of agricultural interests if a bill introduced by Congress passes. Top agriculture and food officials would receive permanent representation on the Committee on Foreign Investment in the United States.

OUTSIDE OF 2014, THE 2022 MILK FUTURES represent the highest first-half averages in history. As a result, margins for producing milk have improved over $2 per hundredweight (cwt.) as shown in the figure below. Read more details in Mike North’s Milk Check Outlook column, “Milk price déjà vu all over again” on page 693 in this issue.