Inflation has officially arrived on the dairy product front as rising feed costs and the resulting tightness in U.S. milk supplies sends butter, cheese, nonfat dry milk, and whey prices climbing to new highs. With milk supplies tightening, processors are prioritizing cheese vats over butter churns.

Cheese and whey production in the U.S. maintains a healthy growth path at the start of the new year, while butter and nonfat dry milk production are making noticeable declines. The drop in butter production during the holiday season (when butter demand is at its seasonal peak) caused processors to pull butter out of inventory in the fourth quarter of 2021.

That pull from inventory was propelled when butter prices came out of the doldrums and rallied to the highest level in six years with nonfat dry milk prices following suit—driving Class IV milk prices to a healthy premium when compared to Class III. While cheese prices remained comparatively flat amid the buildup of inventories in the U.S., nervous buyers are seeing a rally across the dairy complex. Dry whey prices are also accelerating on strong demand for protein.

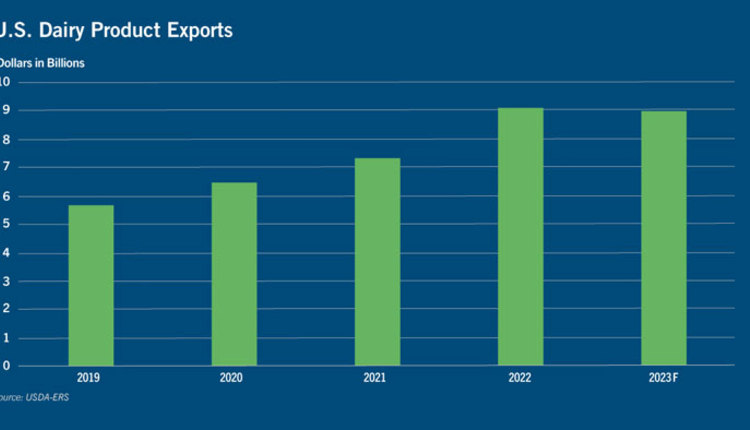

U.S. dairy processors are now grappling over how much cost inflation can be passed on to the consumer via higher prices of retail dairy products. With milk production falling around the world amid resilient global demand for dairy products, the U.S. dairy export program does not look to be slowing down.

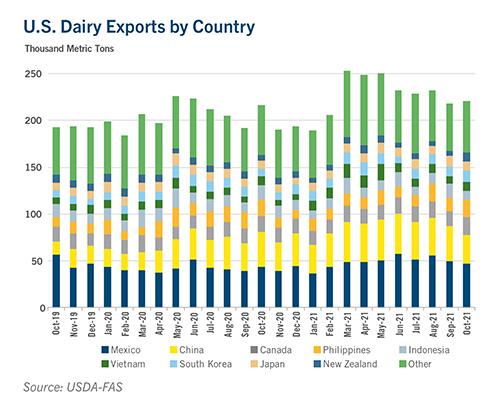

While the volume of U.S. dairy exports has slowed from the record peak last spring, particularly to China, total dairy shipments are notching new record highs despite logistical transportation and shipping constraints. An improvement in port logistics was expected in early 2022, but the omicron surge as it pertains to COVID-19 may delay that and dampen the export pace.

Domestically, processors are closely monitoring production decisions as omicron may again cause a slowdown in the food service sector and a surge in retail grocery sales. At the same time, they are also juggling staffing shortages, a lack of truck drivers, and the associated production disruptions. However, with dairy products now in a much tighter supply situation than last year, processors will finally be in a position to pass along cost increases, something the rest of the food industry complex did in 2021.