Financially, things are bad for U.S. dairy farmers. Dairy cow slaughter is up 5.8% year-to-date, and USDA numbers indicate the size of the milking herd fell 16,000 head between May and June. Expectations are that the herd is going to continue constricting. What will that mean for milk production later this year and early in 2024?

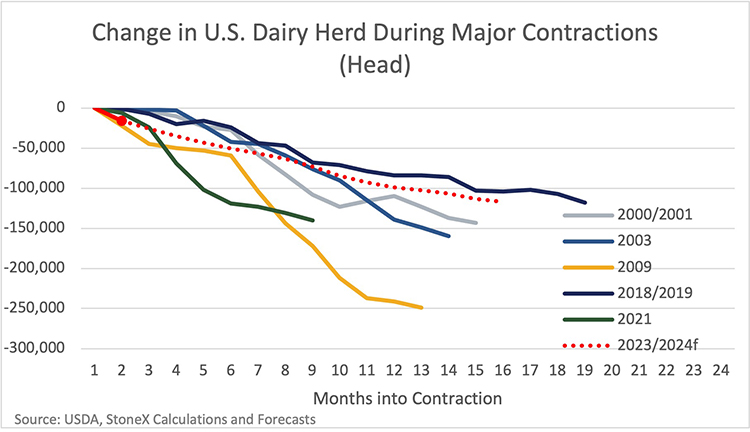

There have been five large and sustained contractions in the dairy herd since 2000. On average, contractions have lasted 13 months and resulted in 162,000 fewer cows (-1.7%) from the peaks. By far, 2009 was the largest contraction in the herd when we lost 249,000 head in 13 months. That was helped along by the Cooperatives Working Together program and its herd buyouts that spent roughly $225 million dollars subsidizing the slaughter of 200,000 cows. That is very unlikely to happen again.

The year 2021 was also an outlier. We saw a record decline in the size of the herd over a six-month period, but it was over quickly and was the shortest contraction at just eight months long. Record-high cheese and milk prices helped drive the herd higher in late 2020 and early 2021, but as demand from the Farmers to Families Food Box program faded, cheese prices reset, milk prices and margins collapsed, and farmers were quick to cut cows in 2021. It’s possible farmers will cut cows at a similar pace again in 2023. The average monthly decline is around 13,000 head, so the 16,000 head cut in June is already an aggressive start to this contraction.

If you exclude 2021, the average decline in the herd during the first six months of a contraction is just 38,000 cows. If you include 2021, it jumps to 54,000 cows. I’m leaning toward a faster-than-average contraction with 57,000 cows coming out between May and November. However, that would only put the herd down 0.4% from last year in November. But with the contraction lasting in 2024, the herd could be down more than 1% by March or April next year.

The production factor

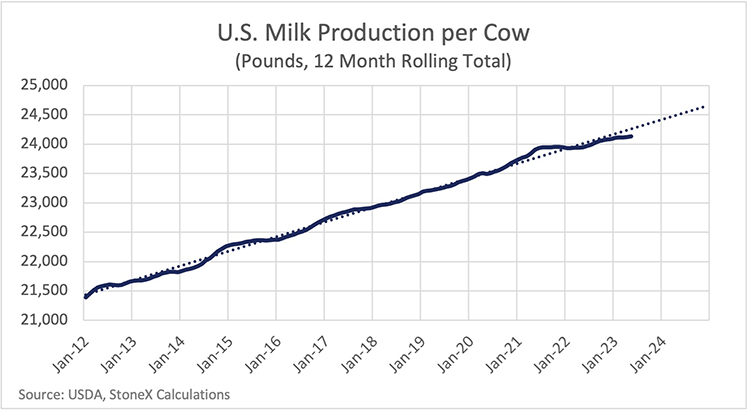

The size of the dairy herd is only half of the milk production equation. The other half is milk production per cow (PPC). Through constant improvement in herd genetics, a greater understanding of the rumen, and improvements in cow care, facilities, and management, there is a very strong and consistent trend toward higher milk production per cow. Sometimes when feed costs are high or there is a period of adverse weather, we will see PPC dip below the long-run trend. Occasionally, when margins are very good, we’ll see above-trend PPC, but the long-run trend is a very good predictor of where PPC will be six to 12 months down the road.

In the first half of 2023, production per cow has been running below trend, likely due to high feed costs and flooding in California (and now excessive heat in July). California has dried out and feed costs are expected to come down in the second half of the year. Given that PPC has been running well below trend, I think the most likely outcome will be PPC getting back toward trend-line growth, which would be around 1.1%.

So, if the herd drops 57,000 head by November, it will only be down 0.4% from last year. We will probably see PPC growth back toward 1.1%, which would mean headline milk production growth would still be around 0.7% in November despite the terrible on-farm margins we are seeing right now. Even as we get into 2024, if the herd is only down 1.1% or less and we continue to see trend growth in PPC, headline milk production will still be about flat against this year.

Supply-side adjustments in response to poor margins have already begun. The herd is expected to decline, but even with a faster-than-average decline, it still might be down less than a half-percent by the end of the year, which could be more than offset by increasing milk production per cow. I could be wrong, as things can always develop differently than in the past. But historically, supply-side adjustments usually play out slowly over a 13-month period and U.S. dairy farmers tend to produce more milk than you think they will.