Most dairy producers will remember the last five years as an extended period of low prices. Consider how the world has changed over this same time span.

- Due to advances in technology for shale oil extraction, U.S. crude oil production climbed by 33 percent. In 2019, U.S. became a net exporter of crude oil.

- Tesla announced that its cars will have the full self-driving capability in the first half of next year.

- Google announced they built a “quantum computer.” This computer is capable of completing in three minutes what traditional supercomputers would take 10,000 years to do.

- In 2014, China overtook the U.S. as the top world economy if measured in terms of “purchasing power parity” via the metric Gross Domestic Product.

- In a surprise win, Donald Trump was elected our 45th president. Reversing the course on trade policy, the new administration abandoned the multilateral approach, engaged in a trade war with China, and aggressively (re)negotiated trade agreements with Canada and Mexico, South Korea, and Japan.

- On April 1, 2015, the European Union abolished milk supply management, initiating a substantial growth in milk production and depressing dairy product prices worldwide. New Zealand milk production has been essentially flat ever since — at first due to economic reasons, and more recently due to natural resource constraints and environmental concerns.

- In 2018, Congress revamped the U.S. dairy safety net, offering generous protection for small to midsize dairy farms, and subsidized crop insurance for farms of all sizes.

It’s a new world

Energy independence is already making the U.S. disinterested in Middle East turmoil. The change in strategic adversary, from Russia to China, will make the U.S. less interested in building coalitions and military alliances.

Potentially tough on ag

All of these geopolitical developments together will make the “America First” doctrine, introduced by President Trump, the de facto foreign policy of the U.S. no matter who wins in the 2020 or 2024 elections. The consequences for U.S. agriculture will be troubling in the short term as our trade partners exert pressure on our agricultural exports in order to win concessions in a broader trade framework.

The U.S. policy response has been to inoculate the dairy sector from short-term trade upheavals through the generous and comprehensive dairy safety net. Going forward, free from the desire to maintain the world order and be the moral leader of the free world, the U.S. will negotiate more aggressively, which will ultimately increase market access for U.S. agricultural goods.

In the world of dairy, New Zealand will have discovered that its geography does not allow it to pursue high rates of growth in the dairy sector any further, and that social license for growth is also ever harder to get and to maintain. European Union will be more focused on making their agricultural sector be “climate-friendly.”

A combined effect will be a new window of opportunity for U.S. dairy exports. This is a development we will need to fully embrace. In absence of strong export performance, the U.S. will need to reduce the national dairy herd by 50,000 cows per year to keep dairy margins at a profitable level.

A bubble burst?

While I am optimistic about the prospects for the U.S. dairy sector in the coming decade, I also see headwinds in the next 12 to 36 months. In the late 1990s, the bubble was in the dotcom sector. In the 2000s, the bubble was in the housing sector, with underregulated financial engineering causing the subprime mortgage crisis. The bubble of 2010s has not yet burst. This time, the bubble is in government deficit financing and corporate debt. Artificially low interest rates, accommodative monetary policy, and debt-led growth in China will eventually run out of the power to propel the current growth cycle.

Be proactive

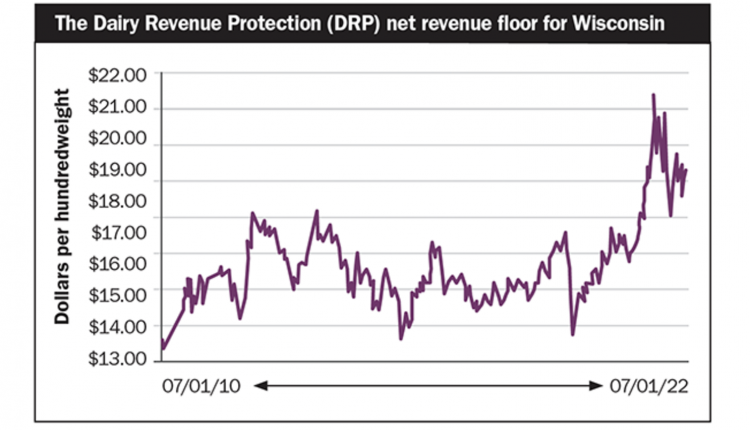

Whether the recession hits in late 2020 or in 2021, dairy producers would be well advised to follow the maxim of Intel’s former CEO Andy Grove: “Only the paranoid survive!” While keeping the upside open, use the risk management tools at your disposal to lock in now the revenue floor for the third and fourth quarter of 2020, and as soon as opportunity allows, put hedges in for 2021 as well. With the new farm bill’s Dairy Margin Coverage program, do not try to guess whether protecting $9.50 per hundredweight (cwt.) or a lower margin would be optimal in 2020.

Any time you focus on such maneuvering is a time you could have spent benchmarking against successful peers and making strategic decisions that position your business well for the exciting, and turbulent decade we are about to enter. The Roaring Twenties are ahead; take the world as you know it for granted at your own peril.