It’s fall. Soon Christmas and the New Year will be upon us!

We again find ourselves enjoying countless gatherings with friends and family. The favorite food guest at most of these parties is cheese. It finds itself on platters and in dips, spreads, balls, and a variety of other culinary treats. Cheese brings people together.

That truth works its way backward through the supply chain as well this time of year. Cheese consumption across every category typically explodes, starting in the third quarter of the year and continues through the first quarter of each new year. Consequently, cheese historically finds a natural buyer ahead of and entering into that span of time. That pattern especially held true in 2019, as buyers have chased after sellers in search of a variety of products.

On a feverish pace

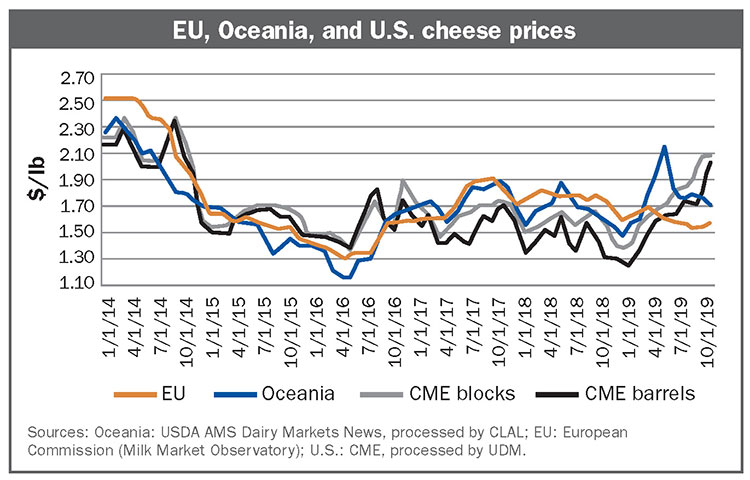

After bottoming out in January, cheese prices set a course for higher ground that took a feverish pace as we entered September.

First it was block cheese. By mid-month, prices peaked at $2.2375 per pound.

That was followed by barrel cheese. It ran a longer course, peaking in early November at $2.39 per pound.

Each had its moment to shine. Each would make sizable setbacks from their highs. However, in all of it, the appetite among domestic buyers was seemingly insatiable. The average spot price of block and barrel Cheddar, as traded at the CME, held above $2 per pound for 34 combined days, up to the time of this writing.

On the farm

For dairymen, the result of strong cheese prices can be immediately felt in the value of Class III milk. Like cheese prices, Class III milk prices soared to levels north of $20 during November. That was the first time dairymen have seen such a price since the glory year of 2014. And given the equity squeeze that has been realized in recent years, it couldn’t have come at a better time.

But one question lives deep in the hearts and minds of dairymen throughout the country — How long can this last?

That is maybe the greatest question to ask and perhaps one of the more difficult to answer. However, if we accept that the value of cheese and whey largely determine the value of Class III milk, then we at least have a starting point. Even though whey has been slowly improving, the ongoing demand (or lack thereof) created by African Swine Fever and tariffs on China will largely keep whey prices in check for some time.

The story now circles back to cheese.

The autumn bid created by domestic buyers as described earlier generally runs dry once holiday orders are filled. From there, the baton is passed to exporters who sell product to foreign buyers.

This is where the story gets interesting, as shown in the chart.

While the average price of blocks and barrels at the CME lives near $2, world values for Cheddar hover at levels far below. Oceania cheese trades near $1.70 per pound, while EU cheese sells for roughly $1.56 per pound.

As we transition away from the strong domestic bid, export business becomes the backstop for marginal loads of cheese looking for a buyer. Unfortunately, since only about 5 percent of cheese is exported, this space is often not large enough to absorb the softening domestic demand.

A soft spring?

With that in mind, block Cheddar at the CME currently stands near $1.85 per pound. To compete in the export arena, a substantial price reduction is likely necessary. This is not uncommon this time of the year. In fact, over the last 10 years, only the winters of 2010 to 2011 and 2013 to 2014 saw higher prices in early spring than where they were in the previous fall.

So while strong cheese markets have persisted through the fall of 2019, dairymen with Class III exposure would serve themselves well to explore coverage against the normal seasonal decline that may lay in store for us. This is not to say that 2020 will be a miserable year with nothing but lower prices. Strong domestic demand has reduced the hefty record inventories that have caused the pain of recent years.

However, normal calendar cycles are still a risk. We currently support price risk management strategies that leverage the optionality found in Dairy Revenue Protection (DRP) or CME options. As providers of these services, we make ourselves available to any questions you might have surrounding them. Likewise, there are many great people throughout the country who also specialize in these services.